Authors

Summary

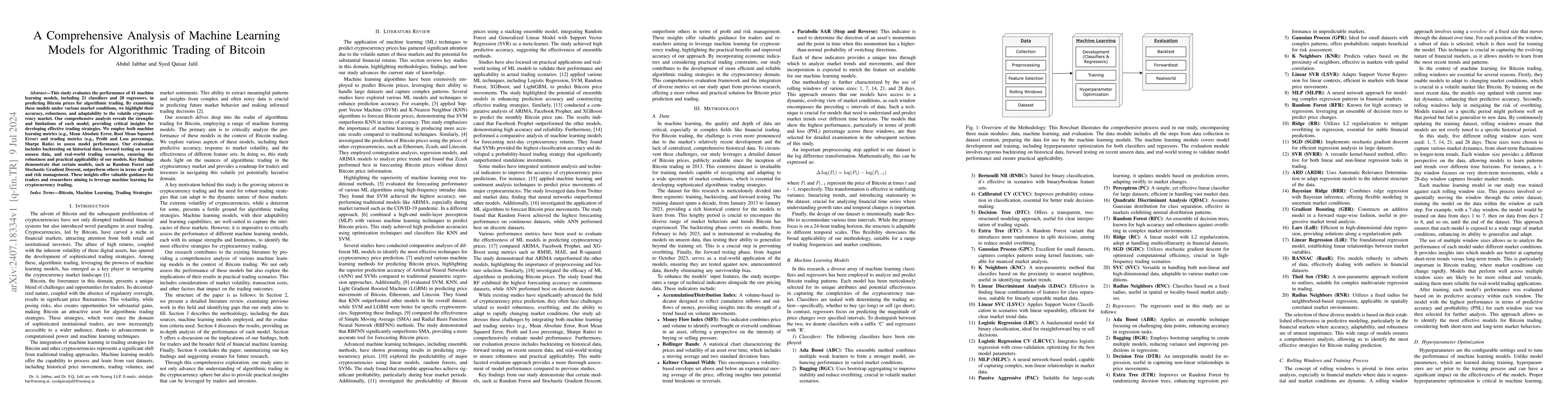

This study evaluates the performance of 41 machine learning models, including 21 classifiers and 20 regressors, in predicting Bitcoin prices for algorithmic trading. By examining these models under various market conditions, we highlight their accuracy, robustness, and adaptability to the volatile cryptocurrency market. Our comprehensive analysis reveals the strengths and limitations of each model, providing critical insights for developing effective trading strategies. We employ both machine learning metrics (e.g., Mean Absolute Error, Root Mean Squared Error) and trading metrics (e.g., Profit and Loss percentage, Sharpe Ratio) to assess model performance. Our evaluation includes backtesting on historical data, forward testing on recent unseen data, and real-world trading scenarios, ensuring the robustness and practical applicability of our models. Key findings demonstrate that certain models, such as Random Forest and Stochastic Gradient Descent, outperform others in terms of profit and risk management. These insights offer valuable guidance for traders and researchers aiming to leverage machine learning for cryptocurrency trading.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)