Authors

Summary

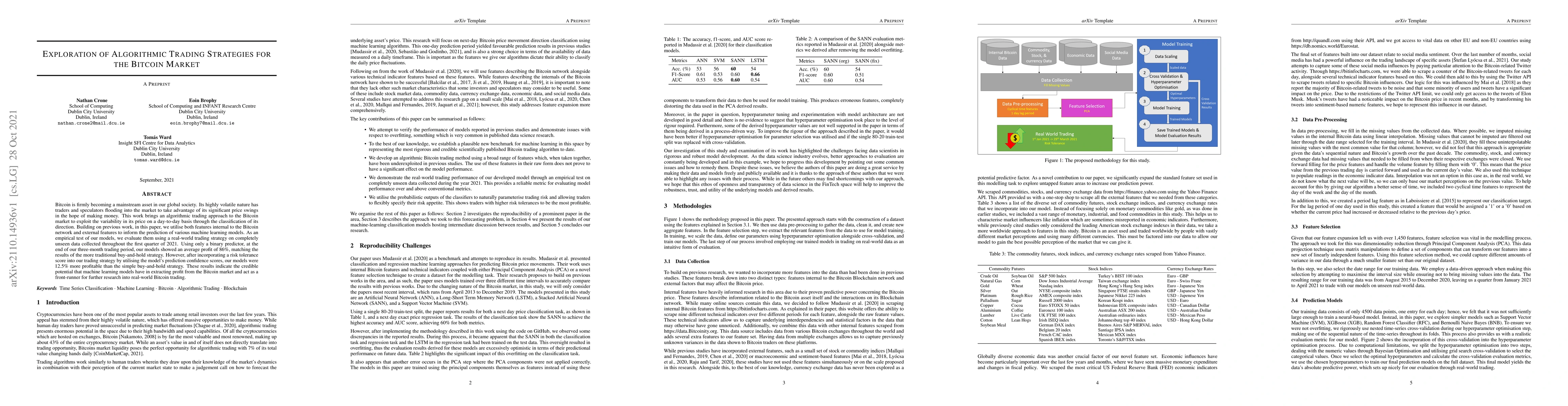

Bitcoin is firmly becoming a mainstream asset in our global society. Its highly volatile nature has traders and speculators flooding into the market to take advantage of its significant price swings in the hope of making money. This work brings an algorithmic trading approach to the Bitcoin market to exploit the variability in its price on a day-to-day basis through the classification of its direction. Building on previous work, in this paper, we utilise both features internal to the Bitcoin network and external features to inform the prediction of various machine learning models. As an empirical test of our models, we evaluate them using a real-world trading strategy on completely unseen data collected throughout the first quarter of 2021. Using only a binary predictor, at the end of our three-month trading period, our models showed an average profit of 86\%, matching the results of the more traditional buy-and-hold strategy. However, after incorporating a risk tolerance score into our trading strategy by utilising the model's prediction confidence scores, our models were 12.5\% more profitable than the simple buy-and-hold strategy. These results indicate the credible potential that machine learning models have in extracting profit from the Bitcoin market and act as a front-runner for further research into real-world Bitcoin trading.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Comprehensive Analysis of Machine Learning Models for Algorithmic Trading of Bitcoin

Abdul Jabbar, Syed Qaisar Jalil

| Title | Authors | Year | Actions |

|---|

Comments (0)