Authors

Summary

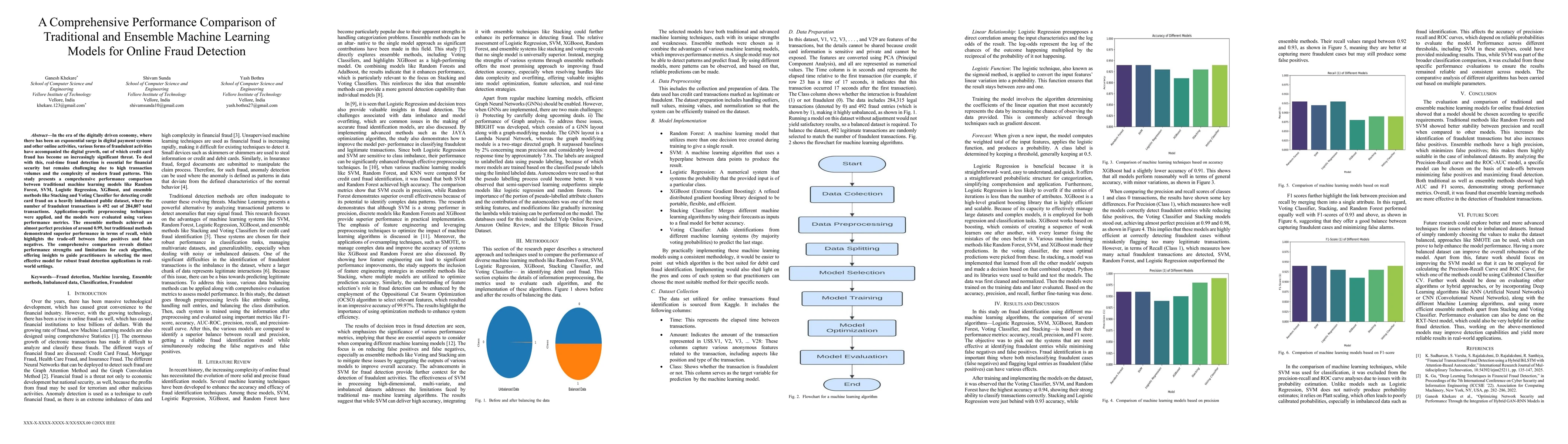

In the era of the digitally driven economy, where there has been an exponential surge in digital payment systems and other online activities, various forms of fraudulent activities have accompanied the digital growth, out of which credit card fraud has become an increasingly significant threat. To deal with this, real-time fraud detection is essential for financial security but remains challenging due to high transaction volumes and the complexity of modern fraud patterns. This study presents a comprehensive performance comparison between traditional machine learning models like Random Forest, SVM, Logistic Regression, XGBoost, and ensemble methods like Stacking and Voting Classifier for detecting credit card fraud on a heavily imbalanced public dataset, where the number of fraudulent transactions is 492 out of 284,807 total transactions. Application-specific preprocessing techniques were applied, and the models were evaluated using various performance metrics. The ensemble methods achieved an almost perfect precision of around 0.99, but traditional methods demonstrated superior performance in terms of recall, which highlights the trade-off between false positives and false negatives. The comprehensive comparison reveals distinct performance strengths and limitations for each algorithm, offering insights to guide practitioners in selecting the most effective model for robust fraud detection applications in real-world settings.

AI Key Findings

Generated Sep 30, 2025

Methodology

The study compared traditional machine learning models (Random Forest, SVM, Logistic Regression, XGBoost) and ensemble methods (Stacking, Voting Classifier) using a highly imbalanced credit card fraud dataset. Data preprocessing techniques were applied, and models were evaluated using accuracy, precision, recall, and F1-score metrics.

Key Results

- Ensemble methods achieved nearly perfect precision (0.99) but traditional methods showed superior recall (0.92-0.93), highlighting the trade-off between false positives and false negatives.

- Voting Classifier, Stacking, and Random Forest achieved the highest accuracy at 0.94, while SVM was excluded from precision-recall and ROC analyses due to probability estimation issues.

- Logistic Regression and SVM demonstrated strong performance in recall but struggled with precision, indicating their limitations in imbalanced datasets.

Significance

This research provides critical insights for selecting appropriate models in fraud detection systems, balancing the need for high precision to minimize false positives and sufficient recall to capture fraudulent transactions.

Technical Contribution

The study demonstrates how feature engineering, optimization algorithms, and ensemble methods can significantly enhance fraud detection performance, particularly in handling imbalanced data and complex transaction patterns.

Novelty

The research uniquely combines traditional machine learning models with ensemble techniques and optimization methods, offering a comprehensive comparison that highlights the trade-offs between precision and recall in fraud detection.

Limitations

- SVM was excluded from precision-recall and ROC analyses due to unreliable probability estimates in imbalanced data.

- The study focused on traditional and ensemble methods, excluding more advanced techniques like deep learning models.

Future Work

- Implement SMOTE and other oversampling techniques to improve model performance on imbalanced datasets.

- Explore hybrid approaches combining machine learning with deep learning models like ANN or CNN for enhanced fraud detection.

- Investigate the use of calibrated classifiers to improve SVM's probability estimates for better precision-recall and ROC analysis.

Paper Details

PDF Preview

Similar Papers

Found 4 papersFinancial Fraud Detection: A Comparative Study of Quantum Machine Learning Models

Mohamed Bennai, Nouhaila Innan, Muhammad Al-Zafar Khan

Proactive Fraud Defense: Machine Learning's Evolving Role in Protecting Against Online Fraud

Md Kamrul Hasan Chy

Application of AI-based Models for Online Fraud Detection and Analysis

Antonis Papasavva, Enrico Mariconti, Nilufer Tuptuk et al.

Comments (0)