Summary

In this research, a comparative study of four Quantum Machine Learning (QML) models was conducted for fraud detection in finance. We proved that the Quantum Support Vector Classifier model achieved the highest performance, with F1 scores of 0.98 for fraud and non-fraud classes. Other models like the Variational Quantum Classifier, Estimator Quantum Neural Network (QNN), and Sampler QNN demonstrate promising results, propelling the potential of QML classification for financial applications. While they exhibit certain limitations, the insights attained pave the way for future enhancements and optimisation strategies. However, challenges exist, including the need for more efficient Quantum algorithms and larger and more complex datasets. The article provides solutions to overcome current limitations and contributes new insights to the field of Quantum Machine Learning in fraud detection, with important implications for its future development.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

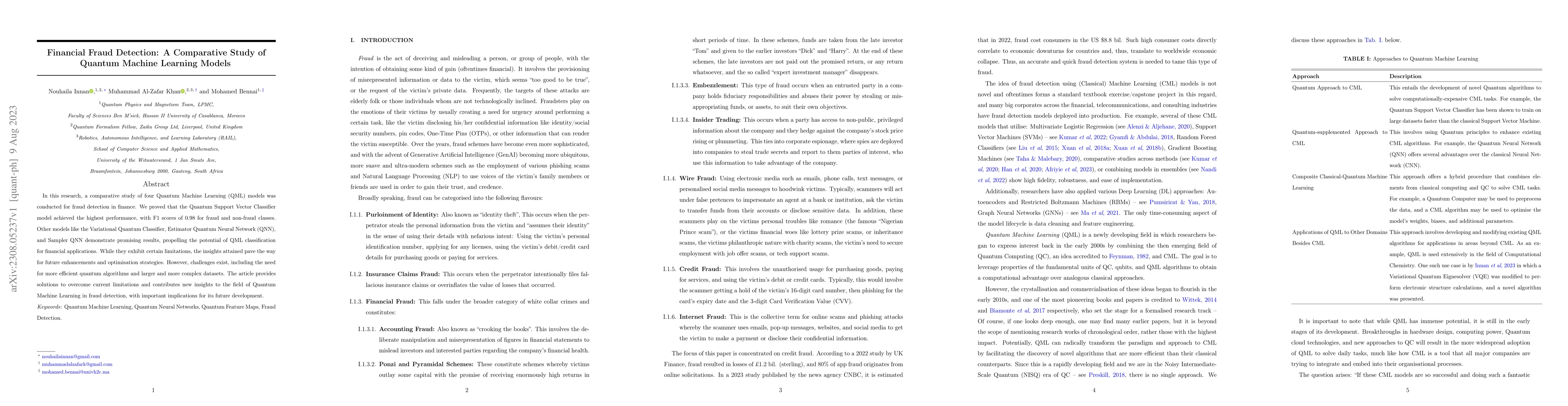

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersComparative Performance Analysis of Quantum Machine Learning Architectures for Credit Card Fraud Detection

Muhammad Shafique, Mohamed Bennai, Nouhaila Innan et al.

FD4QC: Application of Classical and Quantum-Hybrid Machine Learning for Financial Fraud Detection A Technical Report

Luca Pajola, Matteo Cardaioli, Luca Marangoni et al.

QFNN-FFD: Quantum Federated Neural Network for Financial Fraud Detection

Muhammad Shafique, Alberto Marchisio, Mohamed Bennai et al.

Financial Fraud Detection using Quantum Graph Neural Networks

Mohamed Bennai, Nouhaila Innan, Siddhant Dutta et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)