Summary

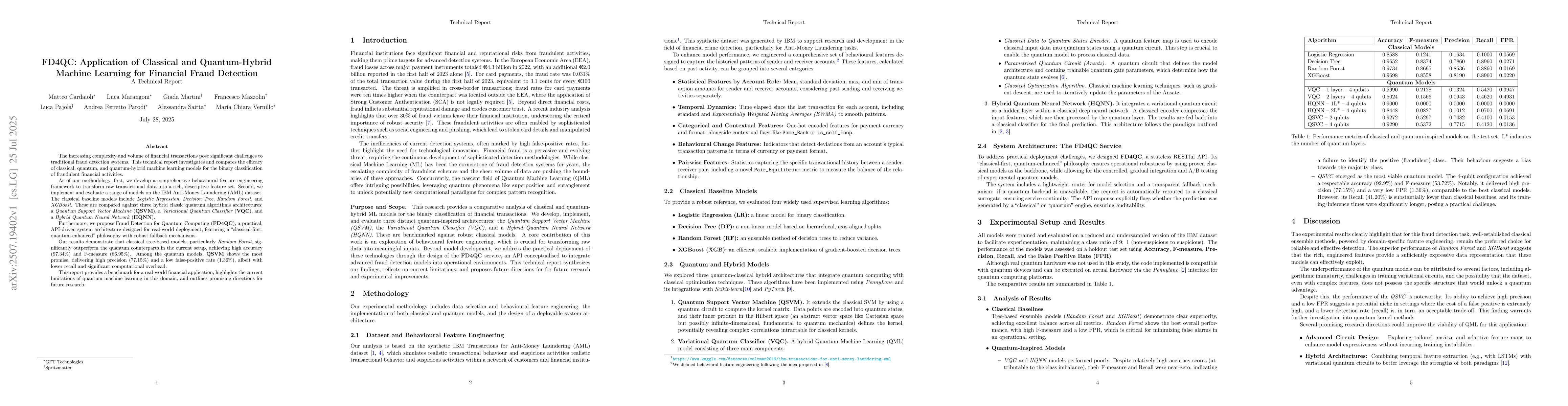

The increasing complexity and volume of financial transactions pose significant challenges to traditional fraud detection systems. This technical report investigates and compares the efficacy of classical, quantum, and quantum-hybrid machine learning models for the binary classification of fraudulent financial activities. As of our methodology, first, we develop a comprehensive behavioural feature engineering framework to transform raw transactional data into a rich, descriptive feature set. Second, we implement and evaluate a range of models on the IBM Anti-Money Laundering (AML) dataset. The classical baseline models include Logistic Regression, Decision Tree, Random Forest, and XGBoost. These are compared against three hybrid classic quantum algorithms architectures: a Quantum Support Vector Machine (QSVM), a Variational Quantum Classifier (VQC), and a Hybrid Quantum Neural Network (HQNN). Furthermore, we propose Fraud Detection for Quantum Computing (FD4QC), a practical, API-driven system architecture designed for real-world deployment, featuring a classical-first, quantum-enhanced philosophy with robust fallback mechanisms. Our results demonstrate that classical tree-based models, particularly \textit{Random Forest}, significantly outperform the quantum counterparts in the current setup, achieving high accuracy (\(97.34\%\)) and F-measure (\(86.95\%\)). Among the quantum models, \textbf{QSVM} shows the most promise, delivering high precision (\(77.15\%\)) and a low false-positive rate (\(1.36\%\)), albeit with lower recall and significant computational overhead. This report provides a benchmark for a real-world financial application, highlights the current limitations of quantum machine learning in this domain, and outlines promising directions for future research.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinancial Fraud Detection: A Comparative Study of Quantum Machine Learning Models

Mohamed Bennai, Nouhaila Innan, Muhammad Al-Zafar Khan

Toward Practical Quantum Machine Learning: A Novel Hybrid Quantum LSTM for Fraud Detection

Gregory T. Byrd, Sujan K. K., Sangram Deshpande et al.

Mixed Quantum-Classical Method For Fraud Detection with Quantum Feature Selection

Michele Grossi, Robert Loredo, Voica Radescu et al.

Unsupervised quantum machine learning for fraud detection

Oleksandr Kyriienko, Einar B. Magnusson

No citations found for this paper.

Comments (0)