Authors

Summary

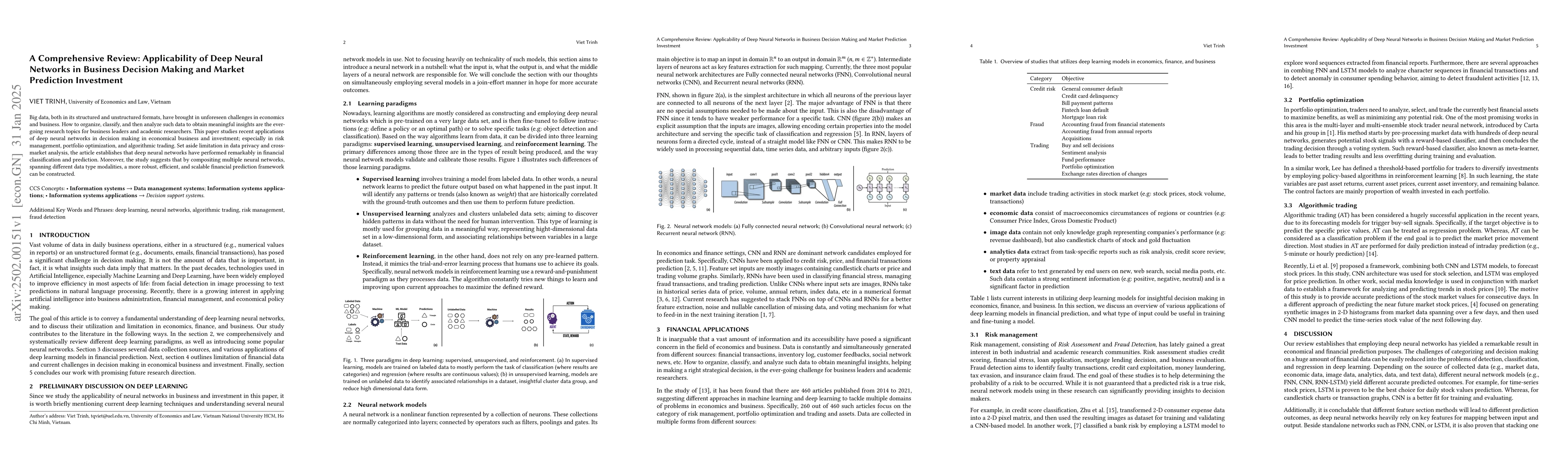

Big data, both in its structured and unstructured formats, have brought in unforeseen challenges in economics and business. How to organize, classify, and then analyze such data to obtain meaningful insights are the ever-going research topics for business leaders and academic researchers. This paper studies recent applications of deep neural networks in decision making in economical business and investment; especially in risk management, portfolio optimization, and algorithmic trading. Set aside limitation in data privacy and cross-market analysis, the article establishes that deep neural networks have performed remarkably in financial classification and prediction. Moreover, the study suggests that by compositing multiple neural networks, spanning different data type modalities, a more robust, efficient, and scalable financial prediction framework can be constructed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)