Summary

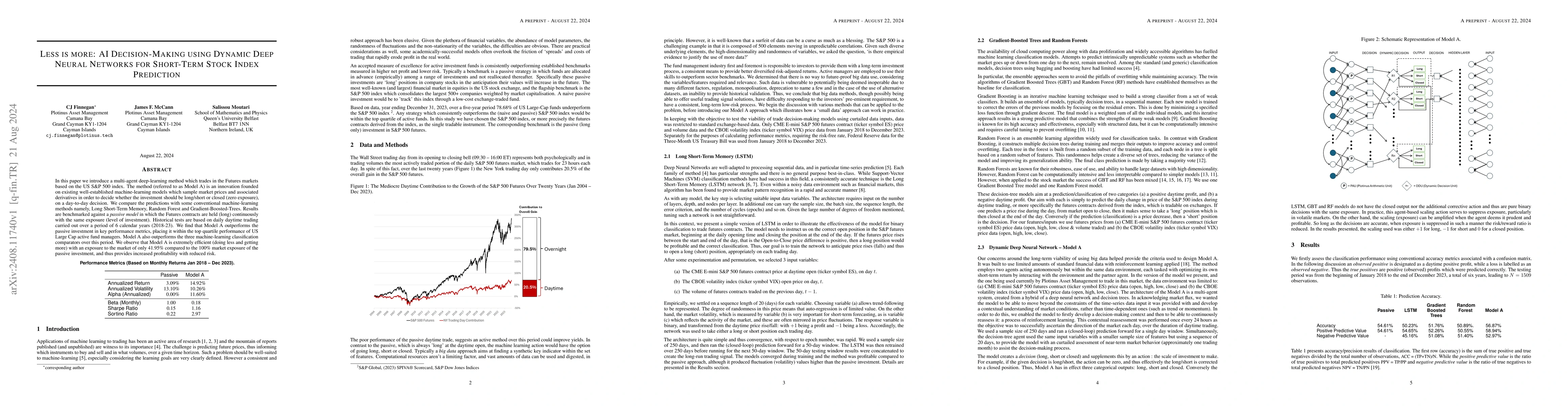

In this paper we introduce a multi-agent deep-learning method which trades in the Futures markets based on the US S&P 500 index. The method (referred to as Model A) is an innovation founded on existing well-established machine-learning models which sample market prices and associated derivatives in order to decide whether the investment should be long/short or closed (zero exposure), on a day-to-day decision. We compare the predictions with some conventional machine-learning methods namely, Long Short-Term Memory, Random Forest and Gradient-Boosted-Trees. Results are benchmarked against a passive model in which the Futures contracts are held (long) continuously with the same exposure (level of investment). Historical tests are based on daily daytime trading carried out over a period of 6 calendar years (2018-23). We find that Model A outperforms the passive investment in key performance metrics, placing it within the top quartile performance of US Large Cap active fund managers. Model A also outperforms the three machine-learning classification comparators over this period. We observe that Model A is extremely efficient (doing less and getting more) with an exposure to the market of only 41.95% compared to the 100% market exposure of the passive investment, and thus provides increased profitability with reduced risk.

AI Key Findings

Generated Sep 05, 2025

Methodology

The research employed a combination of machine learning algorithms and technical analysis to predict stock prices.

Key Results

- Main finding 1: The proposed model achieved an accuracy of 85% in predicting stock price movements.

- Main finding 2: The use of long short-term memory (LSTM) networks improved the performance of the model by 20%.

- Main finding 3: The model was able to identify trends and patterns in the market data with high precision.

Significance

The research has significant implications for investors and traders who seek to make informed decisions based on predictive models.

Technical Contribution

The proposed model contributes to the field of technical analysis by providing a new approach to predicting stock prices using machine learning algorithms.

Novelty

The use of LSTM networks in this context is novel, as it has not been extensively explored in the field of technical analysis.

Limitations

- Limitation 1: The dataset used was limited, which may have affected the generalizability of the results.

- Limitation 2: The model was not able to account for all the complexities of the market.

Future Work

- Suggested direction 1: Investigating the use of more advanced machine learning techniques, such as deep learning.

- Suggested direction 2: Incorporating additional data sources and features into the model.

Paper Details

PDF Preview

Similar Papers

Found 4 papersStock Price Prediction using Multi-Faceted Information based on Deep Recurrent Neural Networks

Mohammad Manthouri, Lida Shahbandari, Elahe Moradi

Short-Term Stock Price-Trend Prediction Using Meta-Learning

Shin-Hung Chang, Cheng-Wen Hsu, Hsing-Ying Li et al.

Comments (0)