Summary

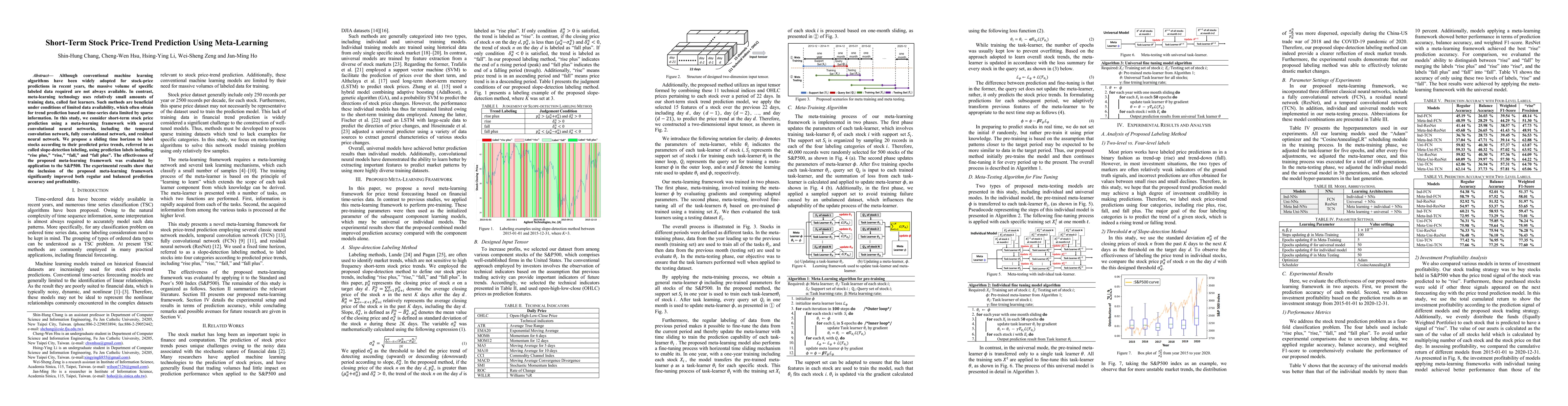

Although conventional machine learning algorithms have been widely adopted for stock-price predictions in recent years, the massive volume of specific labeled data required are not always available. In contrast, meta-learning technology uses relatively small amounts of training data, called fast learners. Such methods are beneficial under conditions of limited data availability, which often obtain for trend prediction based on time-series data limited by sparse information. In this study, we consider short-term stock price prediction using a meta-learning framework with several convolutional neural networks, including the temporal convolution network, fully convolutional network, and residual neural network. We propose a sliding time horizon to label stocks according to their predicted price trends, referred to as called slope-detection labeling, using prediction labels including "rise plus," "rise," "fall," and "fall plus". The effectiveness of the proposed meta-learning framework was evaluated by application to the S&P500. The experimental results show that the inclusion of the proposed meta-learning framework significantly improved both regular and balanced prediction accuracy and profitability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMeta-Stock: Task-Difficulty-Adaptive Meta-learning for Sub-new Stock Price Prediction

Qianli Ma, Zhen Liu, Linghao Wang et al.

LSR-IGRU: Stock Trend Prediction Based on Long Short-Term Relationships and Improved GRU

Yifan Hu, Qinyuan Liu, Peng Zhu et al.

DFT: A Dual-branch Framework of Fluctuation and Trend for Stock Price Prediction

Jia Liu, Zhiyuan Cao, S Kevin Zhou et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)