Authors

Summary

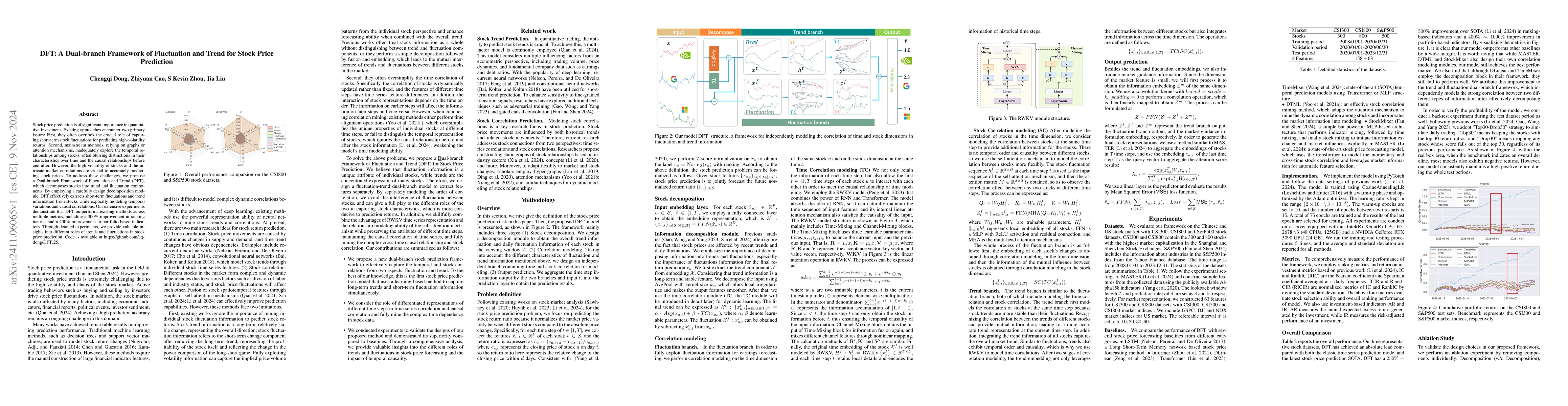

Stock price prediction is of significant importance in quantitative investment. Existing approaches encounter two primary issues: First, they often overlook the crucial role of capturing short-term stock fluctuations for predicting high-volatility returns. Second, mainstream methods, relying on graphs or attention mechanisms, inadequately explore the temporal relationships among stocks, often blurring distinctions in their characteristics over time and the causal relationships before and after. However, the high volatility of stocks and the intricate market correlations are crucial to accurately predicting stock prices. To address these challenges, we propose a Dual-branch Framework of Fluctuation and Trend (DFT), which decomposes stocks into trend and fluctuation components. By employing a carefully design decomposition module, DFT effectively extracts short-term fluctuations and trend information from stocks while explicitly modeling temporal variations and causal correlations. Our extensive experiments demonstrate that DFT outperforms existing methods across multiple metrics, including a 300% improvement in ranking metrics and a 400% improvement in portfolio-based indicators. Through detailed experiments, we provide valuable insights into different roles of trends and fluctuations in stock price prediction.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersShort-Term Stock Price-Trend Prediction Using Meta-Learning

Shin-Hung Chang, Cheng-Wen Hsu, Hsing-Ying Li et al.

TLOB: A Novel Transformer Model with Dual Attention for Stock Price Trend Prediction with Limit Order Book Data

Gjergji Kasneci, Leonardo Berti

LOB-Based Deep Learning Models for Stock Price Trend Prediction: A Benchmark Study

Paola Velardi, Svitlana Vyetrenko, Leonardo Berti et al.

Leveraging Fundamental Analysis for Stock Trend Prediction for Profit

Hung-Fu Chang, John Phan

| Title | Authors | Year | Actions |

|---|

Comments (0)