Authors

Summary

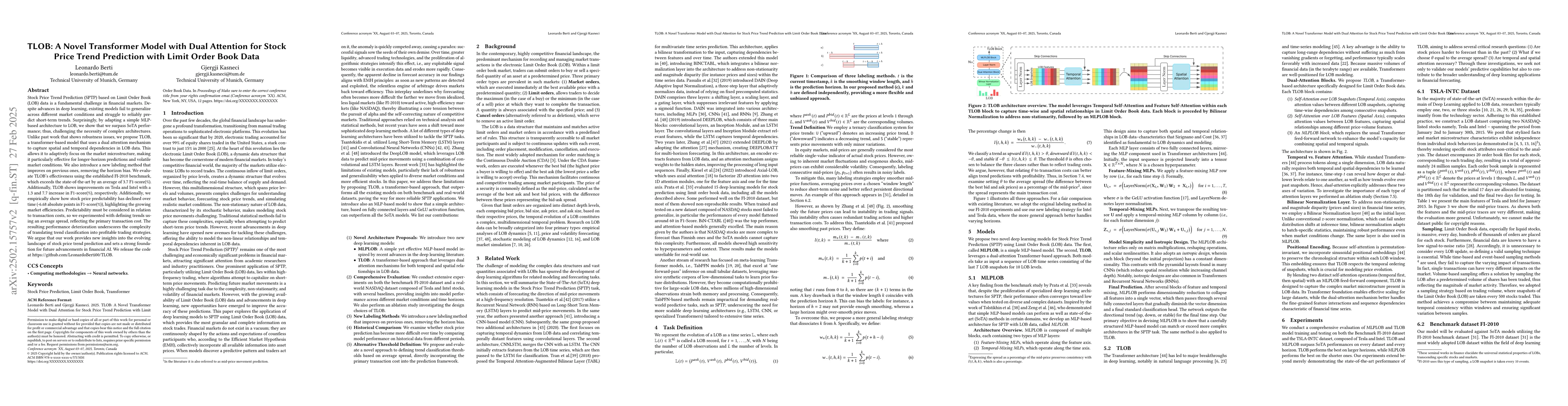

Stock Price Trend Prediction (SPTP) based on Limit Order Book (LOB) data is a fundamental challenge in financial markets. Despite advances in deep learning, existing models fail to generalize across different market conditions and struggle to reliably predict short-term trends. Surprisingly, by adapting a simple MLP-based architecture to LOB, we show that we surpass SoTA performance; thus, challenging the necessity of complex architectures. Unlike past work that shows robustness issues, we propose TLOB, a transformer-based model that uses a dual attention mechanism to capture spatial and temporal dependencies in LOB data. This allows it to adaptively focus on the market microstructure, making it particularly effective for longer-horizon predictions and volatile market conditions. We also introduce a new labeling method that improves on previous ones, removing the horizon bias. We evaluate TLOB's effectiveness using the established FI-2010 benchmark, which exceeds the state-of-the-art by an average of 3.7 F1-score(\%). Additionally, TLOB shows improvements on Tesla and Intel with a 1.3 and 7.7 increase in F1-score(\%), respectively. Additionally, we empirically show how stock price predictability has declined over time (-6.68 absolute points in F1-score(\%)), highlighting the growing market efficiencies. Predictability must be considered in relation to transaction costs, so we experimented with defining trends using an average spread, reflecting the primary transaction cost. The resulting performance deterioration underscores the complexity of translating trend classification into profitable trading strategies. We argue that our work provides new insights into the evolving landscape of stock price trend prediction and sets a strong foundation for future advancements in financial AI. We release the code at https://github.com/LeonardoBerti00/TLOB.

AI Key Findings

Generated Jun 11, 2025

Methodology

The research introduces TLOB, a transformer-based model with dual attention for stock price trend prediction using Limit Order Book (LOB) data. It adapts a simple MLP-based architecture and introduces a new labeling method to remove horizon bias.

Key Results

- TLOB surpasses state-of-the-art performance on FI-2010 benchmark with an average of 3.7 F1-score%.

- TLOB shows improvements on Tesla (1.3 F1-score%) and Intel (7.7 F1-score%) datasets.

- Empirical evidence shows a decline in stock price predictability (-6.68 absolute points in F1-score%).

- TLOB and MLPLOB outperform all state-of-the-art models on FI-2010, Tesla, and Intel datasets.

- TLOB performs better on longer horizons, while MLPLOB performs better on shorter ones.

Significance

This research provides new insights into stock price trend prediction and sets a strong foundation for future advancements in financial AI, challenging the necessity of complex architectures.

Technical Contribution

TLOB, a transformer-based model with dual attention, effectively captures spatial and temporal dependencies in LOB data, allowing adaptive focus on market microstructure for longer-horizon and volatile market predictions.

Novelty

Unlike existing models, TLOB demonstrates robust performance across different market conditions and reliably predicts short-term trends, challenging the necessity of complex architectures.

Limitations

- The proposed methodologies are not yet mature for practical deployment in live trading environments.

- Defining trend thresholds based on average spread significantly impacts model evaluation and potential profitability, highlighting the gap between academic performance metrics and practical trading applicability.

Future Work

- Investigate scaling laws for financial deep learning models.

- Develop more robust approaches to handle increased market efficiency and complexity.

- Explore alternative trend definition methodologies that better align with practical trading constraints.

- Conduct an extensive profitability analysis using backtesting or advanced market simulation methods.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)