Summary

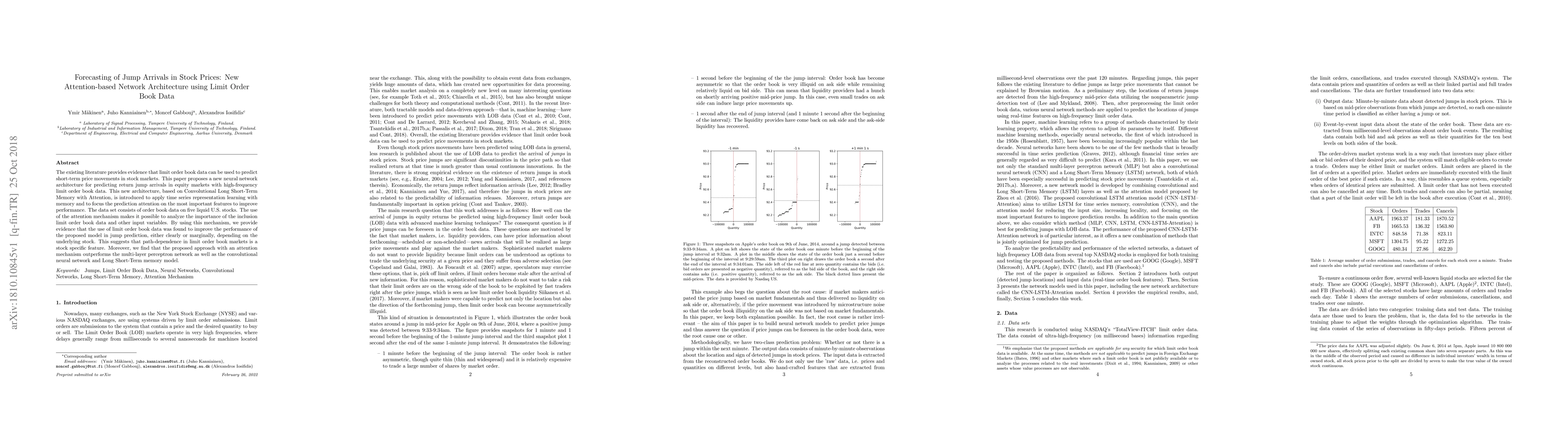

The existing literature provides evidence that limit order book data can be used to predict short-term price movements in stock markets. This paper proposes a new neural network architecture for predicting return jump arrivals in equity markets with high-frequency limit order book data. This new architecture, based on Convolutional Long Short-Term Memory with Attention, is introduced to apply time series representation learning with memory and to focus the prediction attention on the most important features to improve performance. The data set consists of order book data on five liquid U.S. stocks. The use of the attention mechanism makes it possible to analyze the importance of the inclusion limit order book data and other input variables. By using this mechanism, we provide evidence that the use of limit order book data was found to improve the performance of the proposed model in jump prediction, either clearly or marginally, depending on the underlying stock. This suggests that path-dependence in limit order book markets is a stock specific feature. Moreover, we find that the proposed approach with an attention mechanism outperforms the multi-layer perceptron network as well as the convolutional neural network and Long Short-Term memory model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAttention-Based Reading, Highlighting, and Forecasting of the Limit Order Book

Kiseop Lee, Jiwon Jung

Deep Limit Order Book Forecasting

Antonio Briola, Silvia Bartolucci, Tomaso Aste

| Title | Authors | Year | Actions |

|---|

Comments (0)