Authors

Summary

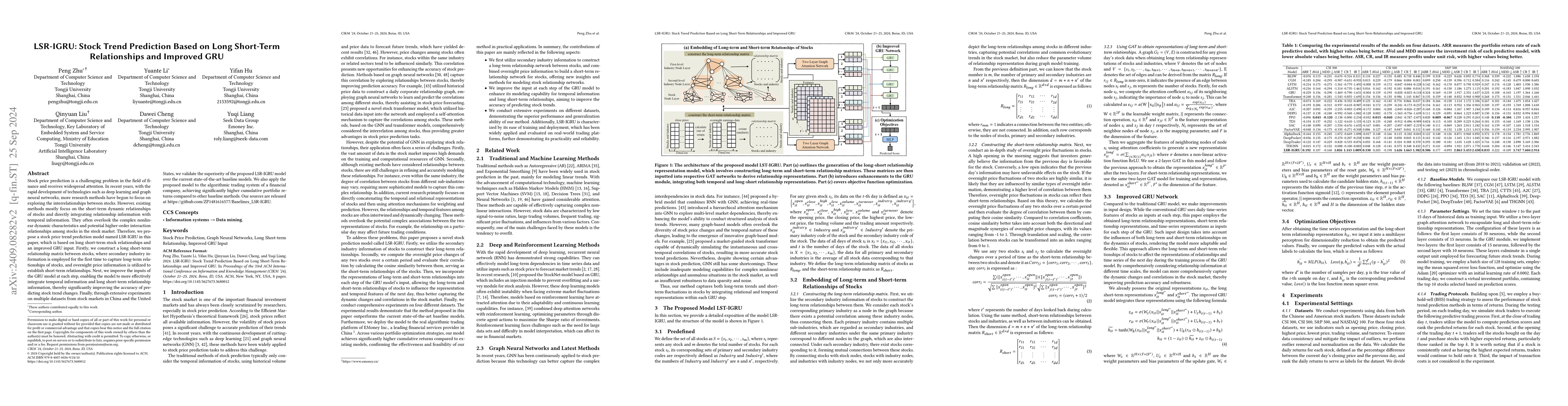

Stock price prediction is a challenging problem in the field of finance and receives widespread attention. In recent years, with the rapid development of technologies such as deep learning and graph neural networks, more research methods have begun to focus on exploring the interrelationships between stocks. However, existing methods mostly focus on the short-term dynamic relationships of stocks and directly integrating relationship information with temporal information. They often overlook the complex nonlinear dynamic characteristics and potential higher-order interaction relationships among stocks in the stock market. Therefore, we propose a stock price trend prediction model named LSR-IGRU in this paper, which is based on long short-term stock relationships and an improved GRU input. Firstly, we construct a long short-term relationship matrix between stocks, where secondary industry information is employed for the first time to capture long-term relationships of stocks, and overnight price information is utilized to establish short-term relationships. Next, we improve the inputs of the GRU model at each step, enabling the model to more effectively integrate temporal information and long short-term relationship information, thereby significantly improving the accuracy of predicting stock trend changes. Finally, through extensive experiments on multiple datasets from stock markets in China and the United States, we validate the superiority of the proposed LSR-IGRU model over the current state-of-the-art baseline models. We also apply the proposed model to the algorithmic trading system of a financial company, achieving significantly higher cumulative portfolio returns compared to other baseline methods. Our sources are released at https://github.com/ZP1481616577/Baselines_LSR-IGRU.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersShort-Term Stock Price-Trend Prediction Using Meta-Learning

Shin-Hung Chang, Cheng-Wen Hsu, Hsing-Ying Li et al.

MCI-GRU: Stock Prediction Model Based on Multi-Head Cross-Attention and Improved GRU

Yifan Hu, Qinyuan Liu, Peng Zhu et al.

Short-term Prediction of Household Electricity Consumption Using Customized LSTM and GRU Models

Rasha Kashef, Saad Emshagin, Wayes Koroni Halim

| Title | Authors | Year | Actions |

|---|

Comments (0)