Authors

Summary

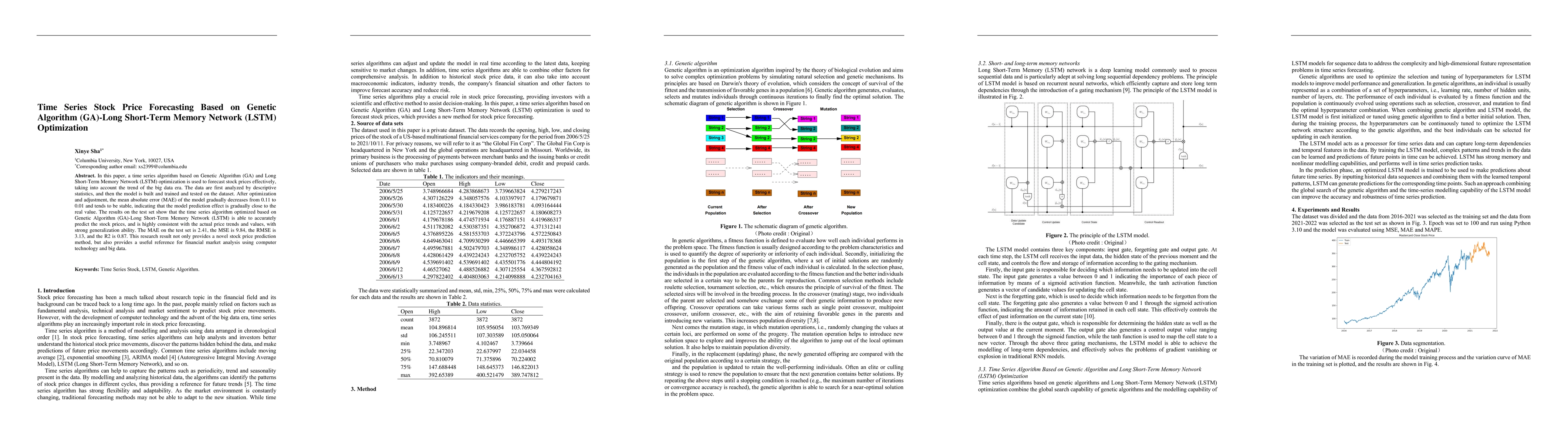

In this paper, a time series algorithm based on Genetic Algorithm (GA) and Long Short-Term Memory Network (LSTM) optimization is used to forecast stock prices effectively, taking into account the trend of the big data era. The data are first analyzed by descriptive statistics, and then the model is built and trained and tested on the dataset. After optimization and adjustment, the mean absolute error (MAE) of the model gradually decreases from 0.11 to 0.01 and tends to be stable, indicating that the model prediction effect is gradually close to the real value. The results on the test set show that the time series algorithm optimized based on Genetic Algorithm (GA)-Long Short-Term Memory Network (LSTM) is able to accurately predict the stock prices, and is highly consistent with the actual price trends and values, with strong generalization ability. The MAE on the test set is 2.41, the MSE is 9.84, the RMSE is 3.13, and the R2 is 0.87. This research result not only provides a novel stock price prediction method, but also provides a useful reference for financial market analysis using computer technology and big data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLong Short-Term Memory Neural Network for Financial Time Series

Carmina Fjellström

Comparative Study of Long Short-Term Memory (LSTM) and Quantum Long Short-Term Memory (QLSTM): Prediction of Stock Market Movement

Tariq Mahmood, Ibtasam Ahmad, Malik Muhammad Zeeshan Ansar et al.

Quantum Kernel-Based Long Short-term Memory for Climate Time-Series Forecasting

Kuan-Cheng Chen, Po-Heng, Lee et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)