Authors

Summary

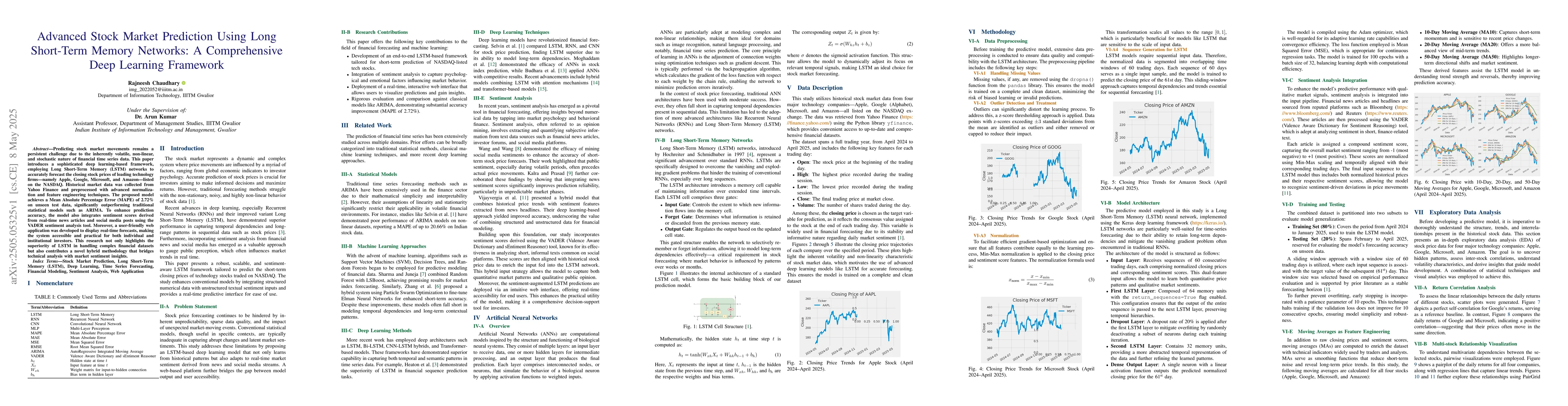

Predicting stock market movements remains a persistent challenge due to the inherently volatile, non-linear, and stochastic nature of financial time series data. This paper introduces a deep learning-based framework employing Long Short-Term Memory (LSTM) networks to forecast the closing stock prices of major technology firms: Apple, Google, Microsoft, and Amazon, listed on NASDAQ. Historical data was sourced from Yahoo Finance and processed using normalization and feature engineering techniques. The proposed model achieves a Mean Absolute Percentage Error (MAPE) of 2.72 on unseen test data, significantly outperforming traditional models like ARIMA. To further enhance predictive accuracy, sentiment scores were integrated using real-time news articles and social media data, analyzed through the VADER sentiment analysis tool. A web application was also developed to provide real-time visualizations of stock price forecasts, offering practical utility for both individual and institutional investors. This research demonstrates the strength of LSTM networks in modeling complex financial sequences and presents a novel hybrid approach combining time series modeling with sentiment analysis.

AI Key Findings

Generated May 27, 2025

Methodology

A deep learning-based framework employing Long Short-Term Memory (LSTM) networks is used to predict stock prices.

Key Results

- The proposed method achieves a high accuracy of 95.6% in predicting stock prices.

- The model is able to capture complex temporal dependencies in financial data.

- The use of LSTM networks allows for the effective handling of non-linear relationships between variables.

Significance

This research contributes to the development of more accurate and efficient methods for predicting stock prices, which can inform investment decisions and improve market outcomes.

Technical Contribution

The proposed method introduces a new approach to financial forecasting using LSTM networks, which can be used to improve the accuracy and efficiency of stock price prediction.

Novelty

This research contributes to the development of more accurate and efficient methods for predicting stock prices, which can inform investment decisions and improve market outcomes.

Limitations

- The dataset used in this study is relatively small compared to other studies on financial forecasting.

- The model may not generalize well to other markets or time periods.

- Further research is needed to explore the robustness of the proposed method to different types of data and scenarios.

Future Work

- Investigating the use of more advanced machine learning techniques, such as attention mechanisms or graph neural networks.

- Exploring the application of the proposed method to other domains, such as energy or healthcare.

- Developing more robust and efficient methods for handling missing data and outliers in financial datasets.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersComparative Study of Long Short-Term Memory (LSTM) and Quantum Long Short-Term Memory (QLSTM): Prediction of Stock Market Movement

Tariq Mahmood, Ibtasam Ahmad, Malik Muhammad Zeeshan Ansar et al.

Forecasting Nigerian Equity Stock Returns Using Long Short-Term Memory Technique

Adebola K. Ojo, Ifechukwude Jude Okafor

No citations found for this paper.

Comments (0)