Summary

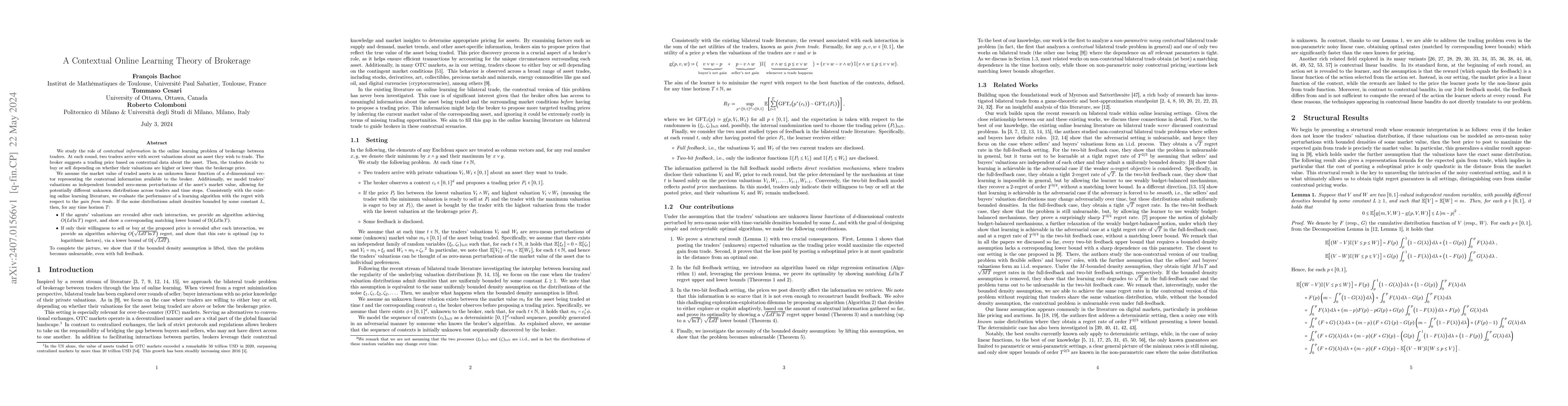

We study the role of contextual information in the online learning problem of brokerage between traders. At each round, two traders arrive with secret valuations about an asset they wish to trade. The broker suggests a trading price based on contextual data about the asset. Then, the traders decide to buy or sell depending on whether their valuations are higher or lower than the brokerage price. We assume the market value of traded assets is an unknown linear function of a $d$-dimensional vector representing the contextual information available to the broker. Additionally, we model traders' valuations as independent bounded zero-mean perturbations of the asset's market value, allowing for potentially different unknown distributions across traders and time steps. Consistently with the existing online learning literature, we evaluate the performance of a learning algorithm with the regret with respect to the gain from trade. If the noise distributions admit densities bounded by some constant $L$, then, for any time horizon $T$: - If the agents' valuations are revealed after each interaction, we provide an algorithm achieving $O ( L d \ln T )$ regret, and show a corresponding matching lower bound of $\Omega( Ld \ln T )$. - If only their willingness to sell or buy at the proposed price is revealed after each interaction, we provide an algorithm achieving $O(\sqrt{LdT \ln T })$ regret, and show that this rate is optimal (up to logarithmic factors), via a lower bound of $\Omega(\sqrt{LdT})$. To complete the picture, we show that if the bounded density assumption is lifted, then the problem becomes unlearnable, even with full feedback.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Online Learning Theory of Brokerage

Tommaso Cesari, Roberto Colomboni, Nataša Bolić

A Tight Regret Analysis of Non-Parametric Repeated Contextual Brokerage

François Bachoc, Tommaso Cesari, Roberto Colomboni

| Title | Authors | Year | Actions |

|---|

Comments (0)