Roberto Colomboni

15 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

A Contextual Online Learning Theory of Brokerage

We study the role of contextual information in the online learning problem of brokerage between traders. At each round, two traders arrive with secret valuations about an asset they wish to trade. T...

Fair Online Bilateral Trade

In online bilateral trade, a platform posts prices to incoming pairs of buyers and sellers that have private valuations for a certain good. If the price is lower than the buyers' valuation and highe...

Trading Volume Maximization with Online Learning

We explore brokerage between traders in an online learning framework. At any round $t$, two traders meet to exchange an asset, provided the exchange is mutually beneficial. The broker proposes a tra...

An Online Learning Theory of Brokerage

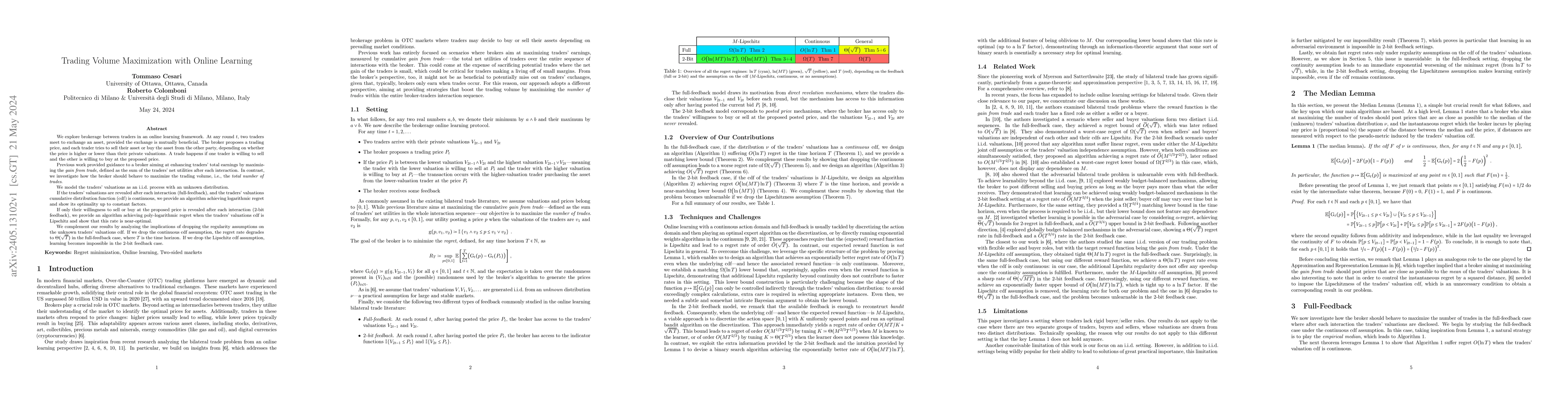

We investigate brokerage between traders from an online learning perspective. At any round $t$, two traders arrive with their private valuations, and the broker proposes a trading price. Unlike othe...

Adaptive maximization of social welfare

We consider the problem of repeatedly choosing policies to maximize social welfare. Welfare is a weighted sum of private utility and public revenue. Earlier outcomes inform later policies. Utility i...

The Role of Transparency in Repeated First-Price Auctions with Unknown Valuations

We study the problem of regret minimization for a single bidder in a sequence of first-price auctions where the bidder discovers the item's value only if the auction is won. Our main contribution is...

An Improved Uniform Convergence Bound with Fat-Shattering Dimension

The fat-shattering dimension characterizes the uniform convergence property of real-valued functions. The state-of-the-art upper bounds feature a multiplicative squared logarithmic factor on the sam...

Repeated Bilateral Trade Against a Smoothed Adversary

We study repeated bilateral trade where an adaptive $\sigma$-smooth adversary generates the valuations of sellers and buyers. We provide a complete characterization of the regret regimes for fixed-p...

Regret Analysis of Dyadic Search

We analyze the cumulative regret of the Dyadic Search algorithm of Bachoc et al. [2022].

A Near-Optimal Algorithm for Univariate Zeroth-Order Budget Convex Optimization

This paper studies a natural generalization of the problem of minimizing a univariate convex function $f$ by querying its values sequentially. At each time-step $t$, the optimizer can invest a budge...

Nonstochastic Bandits with Composite Anonymous Feedback

We investigate a nonstochastic bandit setting in which the loss of an action is not immediately charged to the player, but rather spread over the subsequent rounds in an adversarial way. The instant...

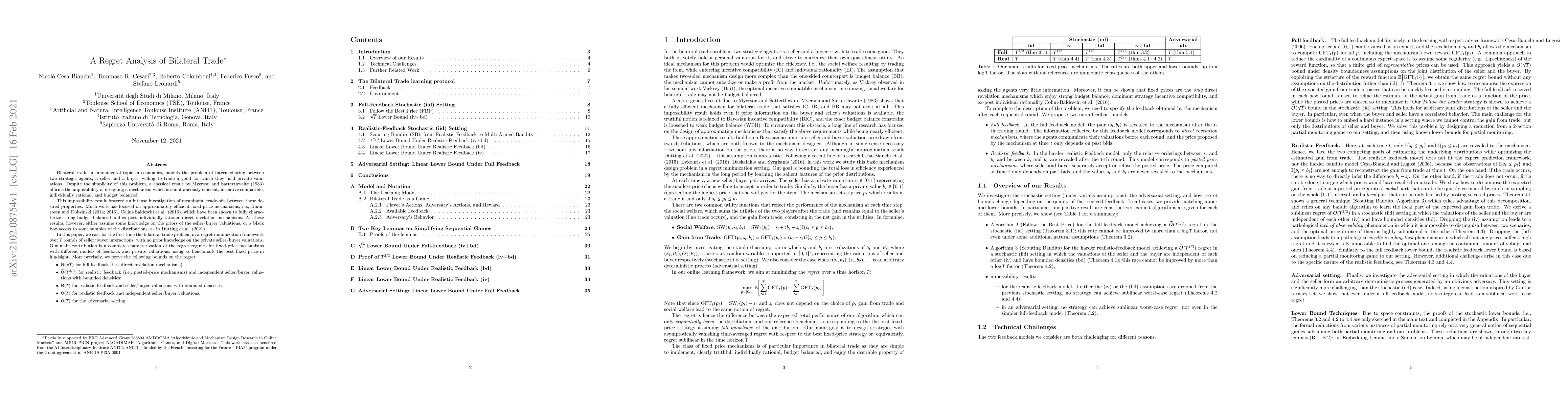

A Regret Analysis of Bilateral Trade

Bilateral trade, a fundamental topic in economics, models the problem of intermediating between two strategic agents, a seller and a buyer, willing to trade a good for which they hold private valuat...

Market Making without Regret

We consider a sequential decision-making setting where, at every round $t$, a market maker posts a bid price $B_t$ and an ask price $A_t$ to an incoming trader (the taker) with a private valuation for...

A Tight Regret Analysis of Non-Parametric Repeated Contextual Brokerage

We study a contextual version of the repeated brokerage problem. In each interaction, two traders with private valuations for an item seek to buy or sell based on the learner's-a broker-proposed price...

Stochastic Bandits for Crowdsourcing and Multi-Platform Autobidding

Motivated by applications in crowdsourcing, where a fixed sum of money is split among $K$ workers, and autobidding, where a fixed budget is used to bid in $K$ simultaneous auctions, we define a stocha...