Summary

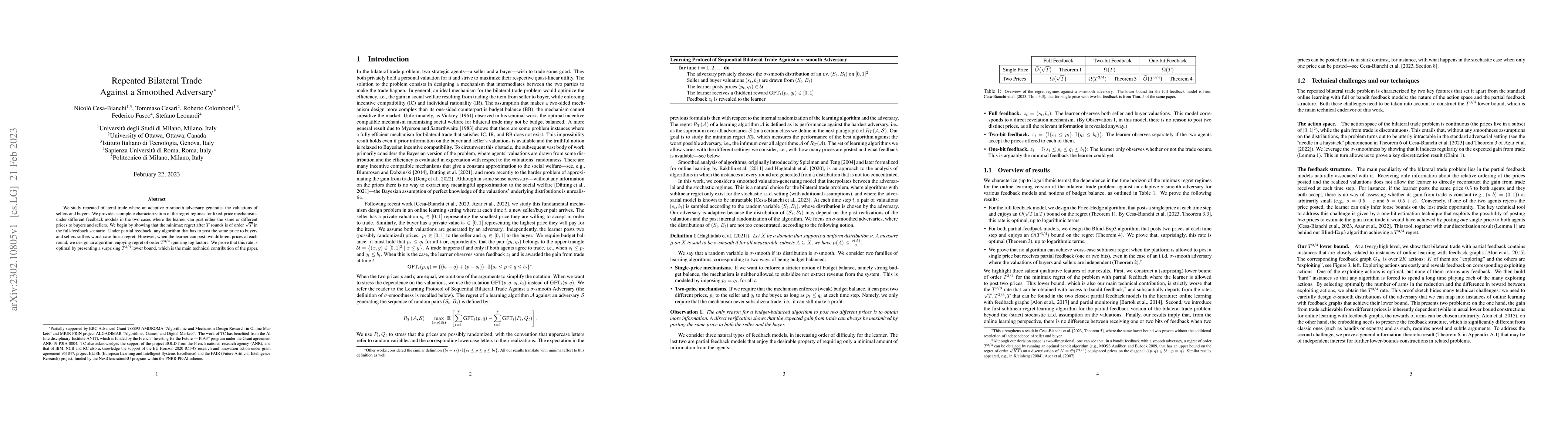

We study repeated bilateral trade where an adaptive $\sigma$-smooth adversary generates the valuations of sellers and buyers. We provide a complete characterization of the regret regimes for fixed-price mechanisms under different feedback models in the two cases where the learner can post either the same or different prices to buyers and sellers. We begin by showing that the minimax regret after $T$ rounds is of order $\sqrt{T}$ in the full-feedback scenario. Under partial feedback, any algorithm that has to post the same price to buyers and sellers suffers worst-case linear regret. However, when the learner can post two different prices at each round, we design an algorithm enjoying regret of order $T^{3/4}$ ignoring log factors. We prove that this rate is optimal by presenting a surprising $T^{3/4}$ lower bound, which is the main technical contribution of the paper.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInternational Trade Flow Prediction with Bilateral Trade Provisions

Caiwen Ding, Jiahui Zhao, Dongjin Song et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)