Summary

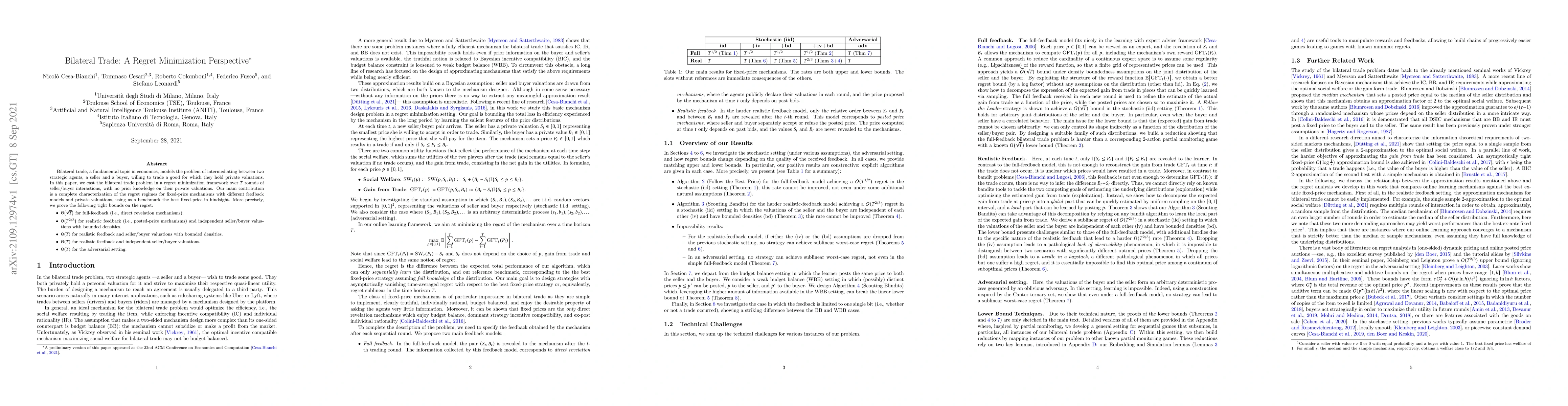

Bilateral trade, a fundamental topic in economics, models the problem of intermediating between two strategic agents, a seller and a buyer, willing to trade a good for which they hold private valuations. In this paper, we cast the bilateral trade problem in a regret minimization framework over $T$ rounds of seller/buyer interactions, with no prior knowledge on their private valuations. Our main contribution is a complete characterization of the regret regimes for fixed-price mechanisms with different feedback models and private valuations, using as a benchmark the best fixed-price in hindsight. More precisely, we prove the following tight bounds on the regret: - $\Theta(\sqrt{T})$ for full-feedback (i.e., direct revelation mechanisms). - $\Theta(T^{2/3})$ for realistic feedback (i.e., posted-price mechanisms) and independent seller/buyer valuations with bounded densities. - $\Theta(T)$ for realistic feedback and seller/buyer valuations with bounded densities. - $\Theta(T)$ for realistic feedback and independent seller/buyer valuations. - $\Theta(T)$ for the adversarial setting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Regret Analysis of Bilateral Trade

Federico Fusco, Stefano Leonardi, Tommaso Cesari et al.

Tight Regret Bounds for Fixed-Price Bilateral Trade

Pinyan Lu, Chihao Zhang, Yaonan Jin et al.

An $\alpha$-regret analysis of Adversarial Bilateral Trade

Federico Fusco, Yossi Azar, Amos Fiat

No-Regret Learning in Bilateral Trade via Global Budget Balance

Andrea Celli, Federico Fusco, Matteo Castiglioni et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)