Summary

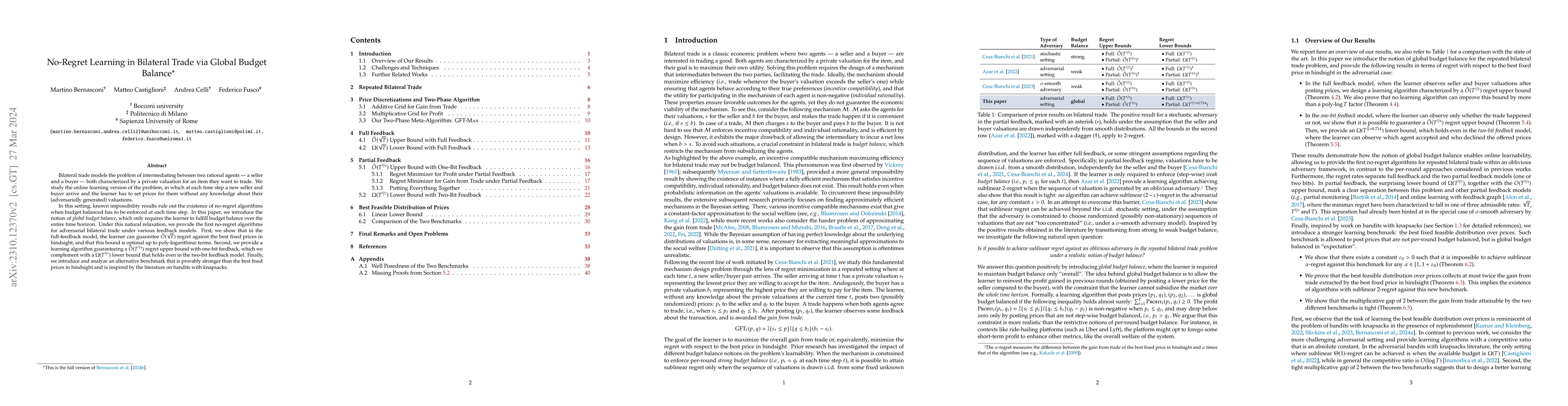

Bilateral trade models the problem of intermediating between two rational agents -- a seller and a buyer -- both characterized by a private valuation for an item they want to trade. We study the online learning version of the problem, in which at each time step a new seller and buyer arrive and the learner has to set prices for them without any knowledge about their (adversarially generated) valuations. In this setting, known impossibility results rule out the existence of no-regret algorithms when budget balanced has to be enforced at each time step. In this paper, we introduce the notion of \emph{global budget balance}, which only requires the learner to fulfill budget balance over the entire time horizon. Under this natural relaxation, we provide the first no-regret algorithms for adversarial bilateral trade under various feedback models. First, we show that in the full-feedback model, the learner can guarantee $\tilde O(\sqrt{T})$ regret against the best fixed prices in hindsight, and that this bound is optimal up to poly-logarithmic terms. Second, we provide a learning algorithm guaranteeing a $\tilde O(T^{3/4})$ regret upper bound with one-bit feedback, which we complement with a $\Omega(T^{5/7})$ lower bound that holds even in the two-bit feedback model. Finally, we introduce and analyze an alternative benchmark that is provably stronger than the best fixed prices in hindsight and is inspired by the literature on bandits with knapsacks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBetter Regret Rates in Bilateral Trade via Sublinear Budget Violation

Matteo Castiglioni, Alberto Marchesi, Anna Lunghi

Tight Regret Bounds for Fixed-Price Bilateral Trade

Pinyan Lu, Chihao Zhang, Yaonan Jin et al.

A Regret Analysis of Bilateral Trade

Federico Fusco, Stefano Leonardi, Tommaso Cesari et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)