Summary

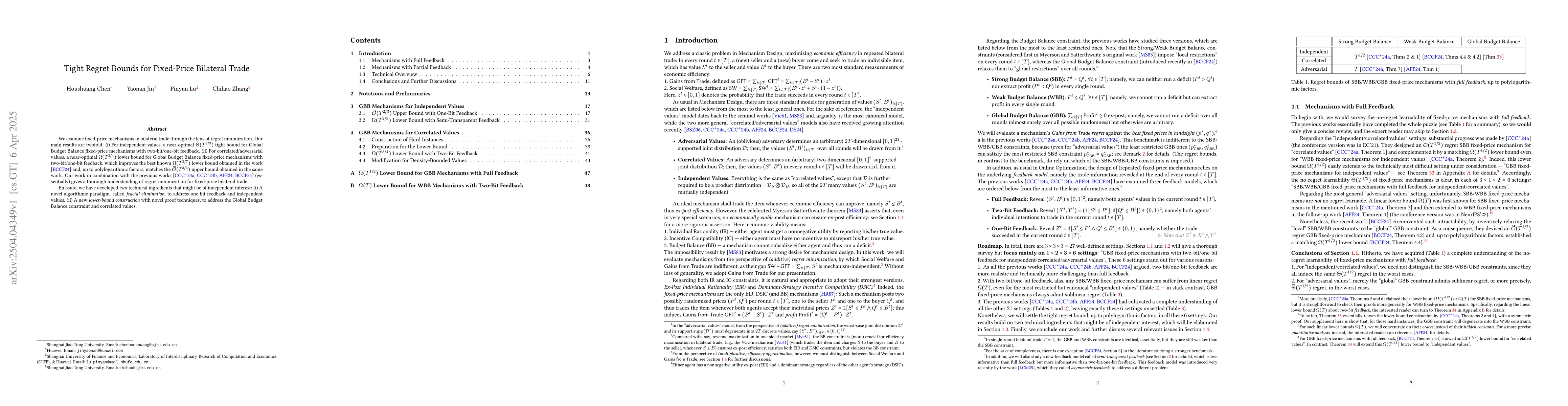

We examine fixed-price mechanisms in bilateral trade through the lens of regret minimization. Our main results are twofold. (i) For independent values, a near-optimal $\widetilde{\Theta}(T^{2/3})$ tight bound for $\textsf{Global Budget Balance}$ fixed-price mechanisms with two-bit/one-bit feedback. (ii) For correlated/adversarial values, a near-optimal $\Omega(T^{3/4})$ lower bound for $\textsf{Global Budget Balance}$ fixed-price mechanisms with two-bit/one-bit feedback, which improves the best known $\Omega(T^{5/7})$ lower bound obtained in the work \cite{BCCF24} and, up to polylogarithmic factors, matches the $\widetilde{\mathcal{O}}(T^{3 / 4})$ upper bound obtained in the same work. Our work in combination with the previous works \cite{CCCFL24mor, CCCFL24jmlr, AFF24, BCCF24} (essentially) gives a thorough understanding of regret minimization for fixed-price bilateral trade. En route, we have developed two technical ingredients that might be of independent interest: (i) A novel algorithmic paradigm, called $\textit{{fractal elimination}}$, to address one-bit feedback and independent values. (ii) A new $\textit{lower-bound construction}$ with novel proof techniques, to address the $\textsf{Global Budget Balance}$ constraint and correlated values.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research employs regret minimization analysis for fixed-price mechanisms in bilateral trade, focusing on independent and correlated/adversarial values with two-bit/one-bit feedback.

Key Results

- For independent values, a near-optimal $\widetilde{\Theta}(T^{2/3})$ tight bound for $\textsf{Global Budget Balance}$ fixed-price mechanisms with two-bit/one-bit feedback.

- For correlated/adversarial values, a near-optimal $\Omega(T^{3/4})$ lower bound for $\textsf{Global Budget Balance}$ fixed-price mechanisms with two-bit/one-bit feedback, improving the previous $\Omega(T^{5/7})$ bound.

Significance

This work, combined with previous research, provides a comprehensive understanding of regret minimization for fixed-price bilateral trade, which has implications for online marketplaces and auction design.

Technical Contribution

The paper introduces a novel algorithmic paradigm, $\textit{fractal elimination}$, for addressing one-bit feedback and independent values, along with a new lower-bound construction technique for the $\textsf{Global Budget Balance}$ constraint with correlated values.

Novelty

This research improves existing lower bounds and provides a thorough understanding of regret minimization in fixed-price bilateral trade, introducing new technical tools like fractal elimination and lower-bound construction methods.

Limitations

- The study focuses on fixed-price mechanisms and does not explore other pricing models.

- The analysis is limited to two-bit/one-bit feedback, which may not capture more nuanced information in real-world scenarios.

Future Work

- Investigate the applicability of these results to other pricing models and feedback mechanisms.

- Explore the extension of these findings to multi-item or continuous value settings.

Paper Details

PDF Preview

Similar Papers

Found 4 papersA Regret Analysis of Bilateral Trade

Federico Fusco, Stefano Leonardi, Tommaso Cesari et al.

Fixed-Price Approximations in Bilateral Trade

Francisco Pernice, Zi Yang Kang, Jan Vondrák

No citations found for this paper.

Comments (0)