Authors

Summary

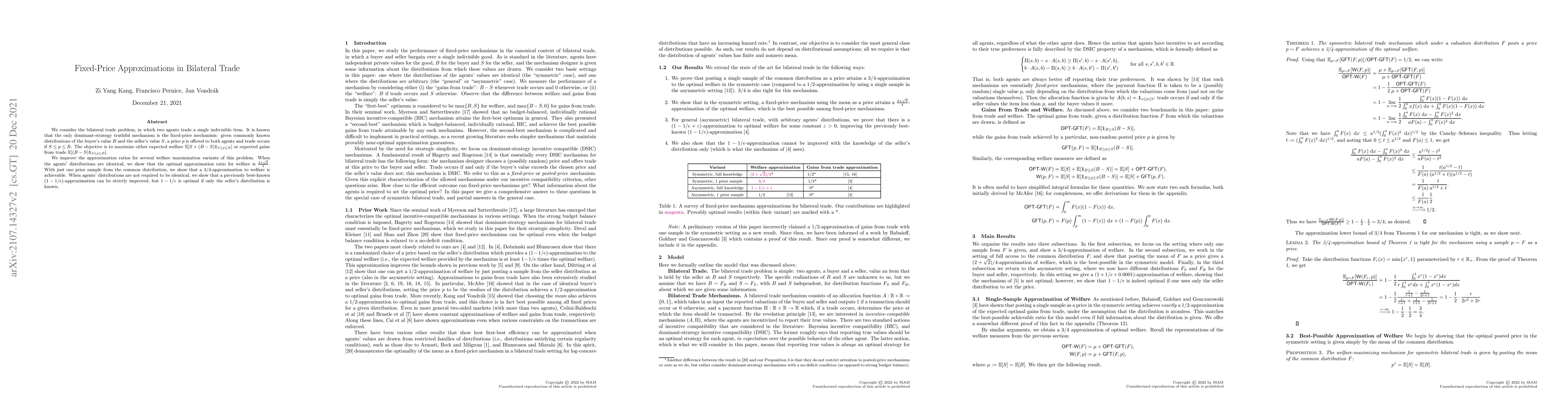

We consider the bilateral trade problem, in which two agents trade a single indivisible item. It is known that the only dominant-strategy truthful mechanism is the fixed-price mechanism: given commonly known distributions of the buyer's value $B$ and the seller's value $S$, a price $p$ is offered to both agents and trade occurs if $S \leq p \leq B$. The objective is to maximize either expected welfare $\mathbb{E}[S + (B-S) \mathbf{1}_{S \leq p \leq B}]$ or expected gains from trade $\mathbb{E}[(B-S) \mathbf{1}_{S \leq p \leq B}]$. We improve the approximation ratios for several welfare maximization variants of this problem. When the agents' distributions are identical, we show that the optimal approximation ratio for welfare is $\frac{2+\sqrt{2}}{4}$. With just one prior sample from the common distribution, we show that a $3/4$-approximation to welfare is achievable. When agents' distributions are not required to be identical, we show that a previously best-known $(1-1/e)$-approximation can be strictly improved, but $1-1/e$ is optimal if only the seller's distribution is known.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTight Regret Bounds for Fixed-Price Bilateral Trade

Pinyan Lu, Chihao Zhang, Yaonan Jin et al.

Improved Approximation Ratios of Fixed-Price Mechanisms in Bilateral Trades

Zihe Wang, Zhengyang Liu, Zeyu Ren

| Title | Authors | Year | Actions |

|---|

Comments (0)