Authors

Summary

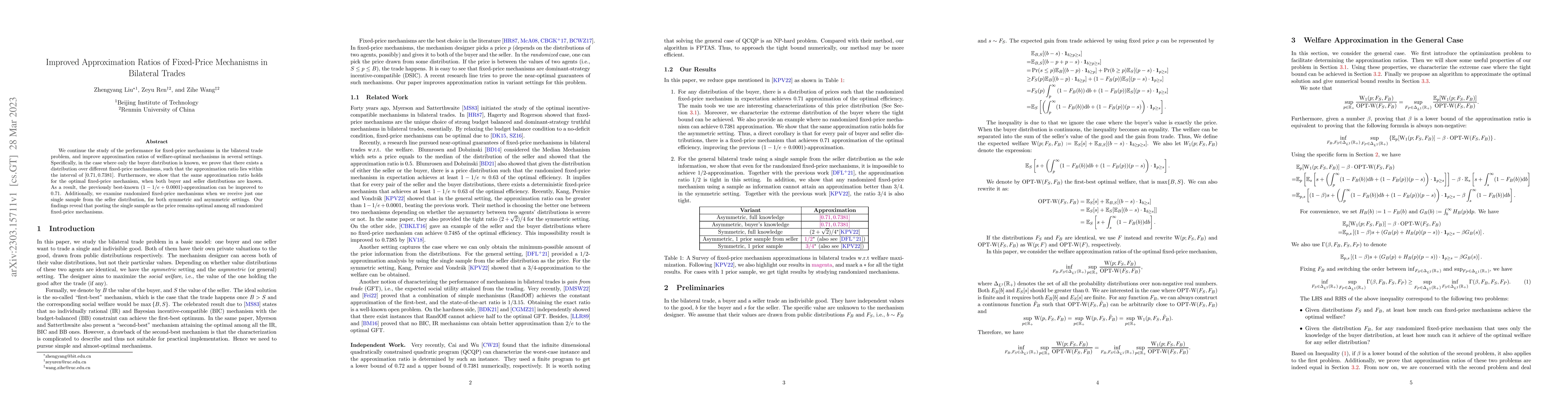

We continue the study of the performance for fixed-price mechanisms in the bilateral trade problem, and improve approximation ratios of welfare-optimal mechanisms in several settings. Specifically, in the case where only the buyer distribution is known, we prove that there exists a distribution over different fixed-price mechanisms, such that the approximation ratio lies within the interval of [0.71, 0.7381]. Furthermore, we show that the same approximation ratio holds for the optimal fixed-price mechanism, when both buyer and seller distributions are known. As a result, the previously best-known (1 - 1/e+0.0001)-approximation can be improved to $0.71$. Additionally, we examine randomized fixed-price mechanisms when we receive just one single sample from the seller distribution, for both symmetric and asymmetric settings. Our findings reveal that posting the single sample as the price remains optimal among all randomized fixed-price mechanisms.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFixed-Price Approximations in Bilateral Trade

Francisco Pernice, Zi Yang Kang, Jan Vondrák

Tight Regret Bounds for Fixed-Price Bilateral Trade

Pinyan Lu, Chihao Zhang, Yaonan Jin et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)