Summary

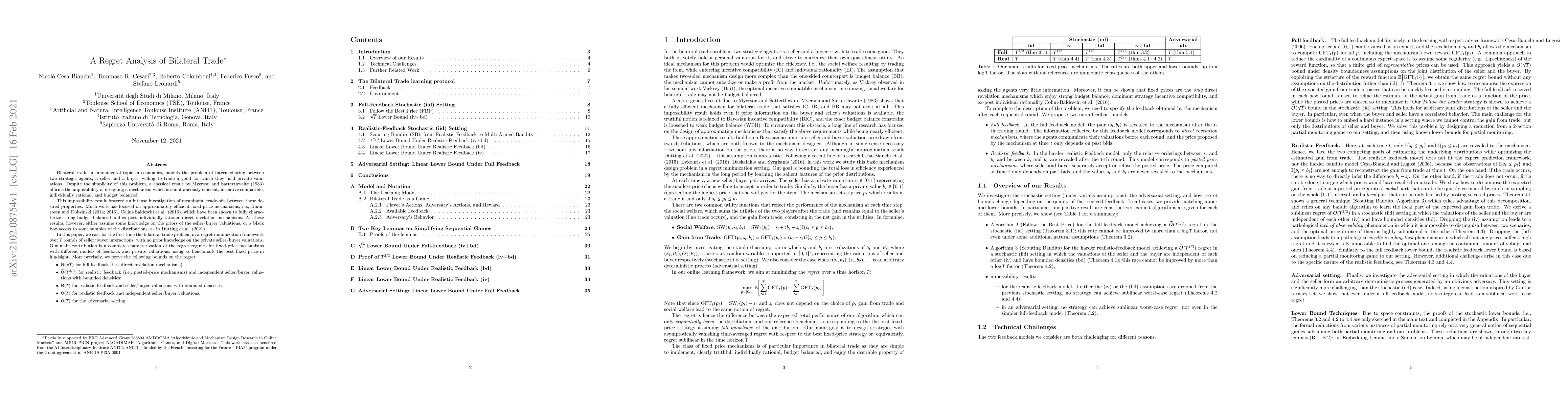

Bilateral trade, a fundamental topic in economics, models the problem of intermediating between two strategic agents, a seller and a buyer, willing to trade a good for which they hold private valuations. Despite the simplicity of this problem, a classical result by Myerson and Satterthwaite (1983) affirms the impossibility of designing a mechanism which is simultaneously efficient, incentive compatible, individually rational, and budget balanced. This impossibility result fostered an intense investigation of meaningful trade-offs between these desired properties. Much work has focused on approximately efficient fixed-price mechanisms, i.e., Blumrosen and Dobzinski (2014; 2016), Colini-Baldeschi et al. (2016), which have been shown to fully characterize strong budget balanced and ex-post individually rational direct revelation mechanisms. All these results, however, either assume some knowledge on the priors of the seller/buyer valuations, or a black box access to some samples of the distributions, as in D{\"u}tting et al. (2021). In this paper, we cast for the first time the bilateral trade problem in a regret minimization framework over rounds of seller/buyer interactions, with no prior knowledge on the private seller/buyer valuations. Our main contribution is a complete characterization of the regret regimes for fixed-price mechanisms with different models of feedback and private valuations, using as benchmark the best fixed price in hindsight. More precisely, we prove the following bounds on the regret: $\bullet$ $\widetilde{\Theta}(\sqrt{T})$ for full-feedback (i.e., direct revelation mechanisms); $\bullet$ $\widetilde{\Theta}(T^{2/3})$ for realistic feedback (i.e., posted-price mechanisms) and independent seller/buyer valuations with bounded densities; $\bullet$ $\Theta(T)$ for realistic feedback and seller/buyer valuations with bounded densities; $\bullet$ $\Theta(T)$ for realistic feedback and independent seller/buyer valuations; $\bullet$ $\Theta(T)$ for the adversarial setting.

AI Key Findings

Generated Sep 03, 2025

Methodology

The research employs a regret minimization framework to analyze bilateral trade, characterizing regret regimes for fixed-price mechanisms under different feedback models and private valuation assumptions.

Key Results

- Complete characterization of regret regimes for fixed-price mechanisms with full-feedback, realistic feedback, and adversarial settings.

- Proven bounds of $\widetilde{\Theta}(\sqrt{T})$ for full-feedback mechanisms, $\widetilde{\Theta}(T^{2/3})$ for realistic feedback with bounded density valuations, and $\Theta(T)$ for other cases.

- Demonstrated that no strategy can beat the $T^{2/3}$ rate in the i.i.d. adversarial setting with bounded density valuations.

- Established a linear lower bound of $\Theta(T)$ for realistic feedback under various distribution assumptions.

- Proved a linear lower bound of $\Theta(T)$ for the adversarial setting under full feedback.

Significance

This work initiates the study of bilateral trade in a regret minimization framework, providing tight bounds on achievable regret rates under various feedback and private valuation models, which opens avenues for future research in multi-sided markets and weak budget balance mechanisms.

Technical Contribution

The paper presents a novel approach to analyzing bilateral trade using regret minimization, providing comprehensive characterizations of regret regimes for fixed-price mechanisms under different feedback models and valuation assumptions.

Novelty

This research distinguishes itself by casting bilateral trade in a regret minimization framework with no prior knowledge on private valuations, offering a fresh perspective on classical Myerson-Satterthwaite impossibility results and providing detailed regret bounds for various mechanism types and feedback models.

Limitations

- The analysis assumes no prior knowledge of seller/buyer valuation distributions, which might not reflect real-world scenarios where some information is often available.

- The focus is primarily on fixed-price mechanisms, potentially overlooking the performance of other mechanism types in regret minimization.

Future Work

- Investigate more general settings with multiple buyers and sellers, different prior distributions, and complex valuation functions.

- Tightly characterize the regret rates for weak budget balance mechanisms, which may outperform strong budget balance mechanisms in certain cases.

- Explore other classes of markets that assume prior knowledge of agent preferences within a regret minimization framework.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn $\alpha$-regret analysis of Adversarial Bilateral Trade

Federico Fusco, Yossi Azar, Amos Fiat

Tight Regret Bounds for Fixed-Price Bilateral Trade

Pinyan Lu, Chihao Zhang, Yaonan Jin et al.

No-Regret Learning in Bilateral Trade via Global Budget Balance

Andrea Celli, Federico Fusco, Matteo Castiglioni et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)