Summary

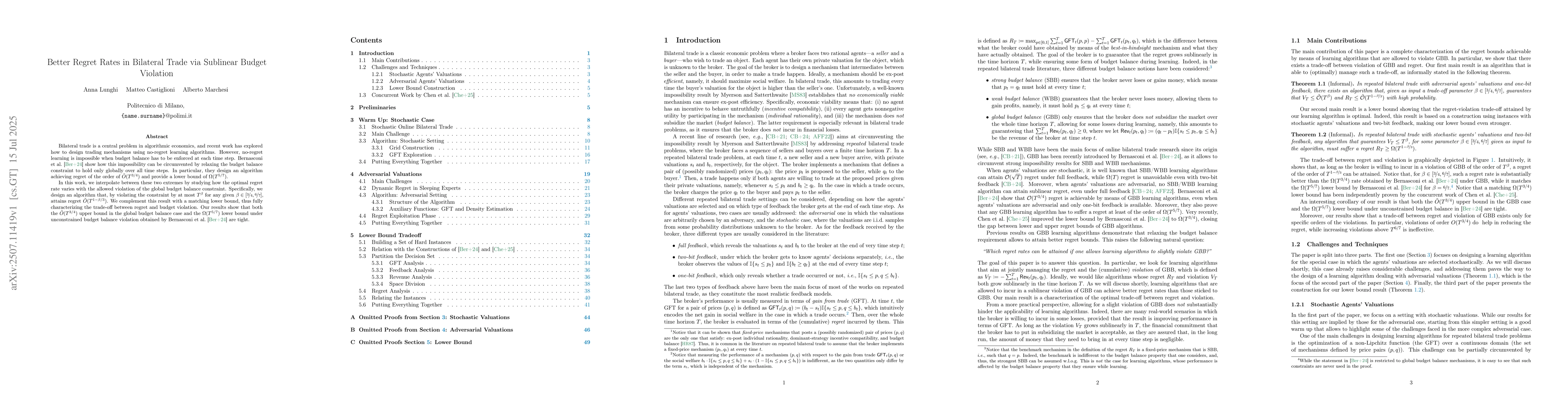

Bilateral trade is a central problem in algorithmic economics, and recent work has explored how to design trading mechanisms using no-regret learning algorithms. However, no-regret learning is impossible when budget balance has to be enforced at each time step. Bernasconi et al. [Ber+24] show how this impossibility can be circumvented by relaxing the budget balance constraint to hold only globally over all time steps. In particular, they design an algorithm achieving regret of the order of $\tilde O(T^{3/4})$ and provide a lower bound of $\Omega(T^{5/7})$. In this work, we interpolate between these two extremes by studying how the optimal regret rate varies with the allowed violation of the global budget balance constraint. Specifically, we design an algorithm that, by violating the constraint by at most $T^{\beta}$ for any given $\beta \in [\frac{3}{4}, \frac{6}{7}]$, attains regret $\tilde O(T^{1 - \beta/3})$. We complement this result with a matching lower bound, thus fully characterizing the trade-off between regret and budget violation. Our results show that both the $\tilde O(T^{3/4})$ upper bound in the global budget balance case and the $\Omega(T^{5/7})$ lower bound under unconstrained budget balance violation obtained by Bernasconi et al. [Ber+24] are tight.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersNo-Regret Learning in Bilateral Trade via Global Budget Balance

Andrea Celli, Federico Fusco, Matteo Castiglioni et al.

An $\alpha$-regret analysis of Adversarial Bilateral Trade

Federico Fusco, Yossi Azar, Amos Fiat

A Regret Analysis of Bilateral Trade

Federico Fusco, Stefano Leonardi, Tommaso Cesari et al.

Tight Regret Bounds for Fixed-Price Bilateral Trade

Pinyan Lu, Chihao Zhang, Yaonan Jin et al.

No citations found for this paper.

Comments (0)