Summary

In online bilateral trade, a platform posts prices to incoming pairs of buyers and sellers that have private valuations for a certain good. If the price is lower than the buyers' valuation and higher than the sellers' valuation, then a trade takes place. Previous work focused on the platform perspective, with the goal of setting prices maximizing the gain from trade (the sum of sellers' and buyers' utilities). Gain from trade is, however, potentially unfair to traders, as they may receive highly uneven shares of the total utility. In this work we enforce fairness by rewarding the platform with the fair gain from trade, defined as the minimum between sellers' and buyers' utilities. After showing that any no-regret learning algorithm designed to maximize the sum of the utilities may fail badly with fair gain from trade, we present our main contribution: a complete characterization of the regret regimes for fair gain from trade when, after each interaction, the platform only learns whether each trader accepted the current price. Specifically, we prove the following regret bounds: $\Theta(\ln T)$ in the deterministic setting, $\Omega(T)$ in the stochastic setting, and $\tilde{\Theta}(T^{2/3})$ in the stochastic setting when sellers' and buyers' valuations are independent of each other. We conclude by providing tight regret bounds when, after each interaction, the platform is allowed to observe the true traders' valuations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

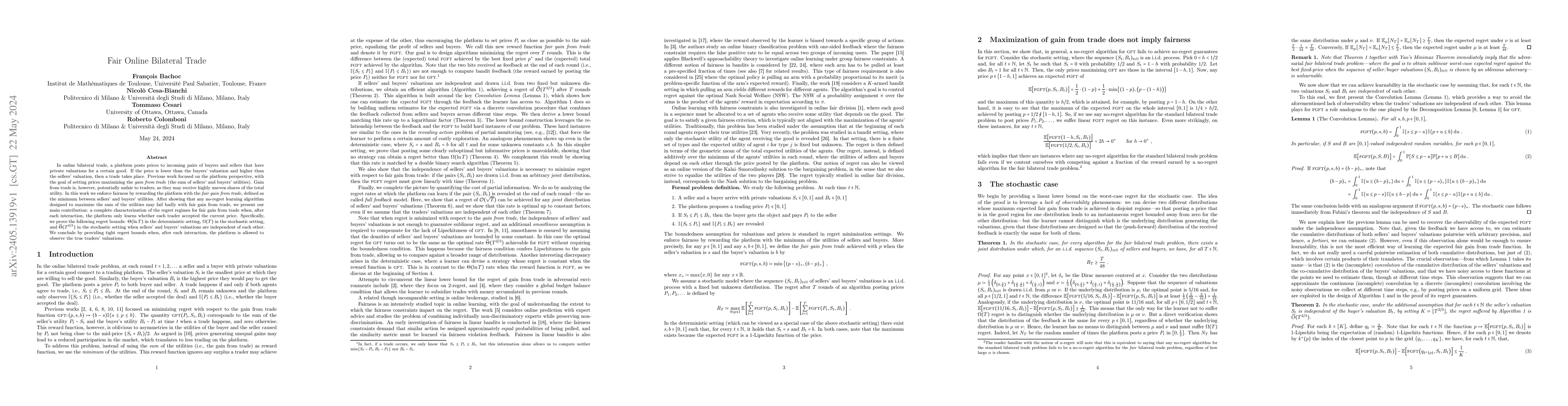

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFeature-Based Online Bilateral Trade

Andrea Celli, Vianney Perchet, Solenne Gaucher et al.

International Trade Flow Prediction with Bilateral Trade Provisions

Caiwen Ding, Jiahui Zhao, Dongjin Song et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)