Summary

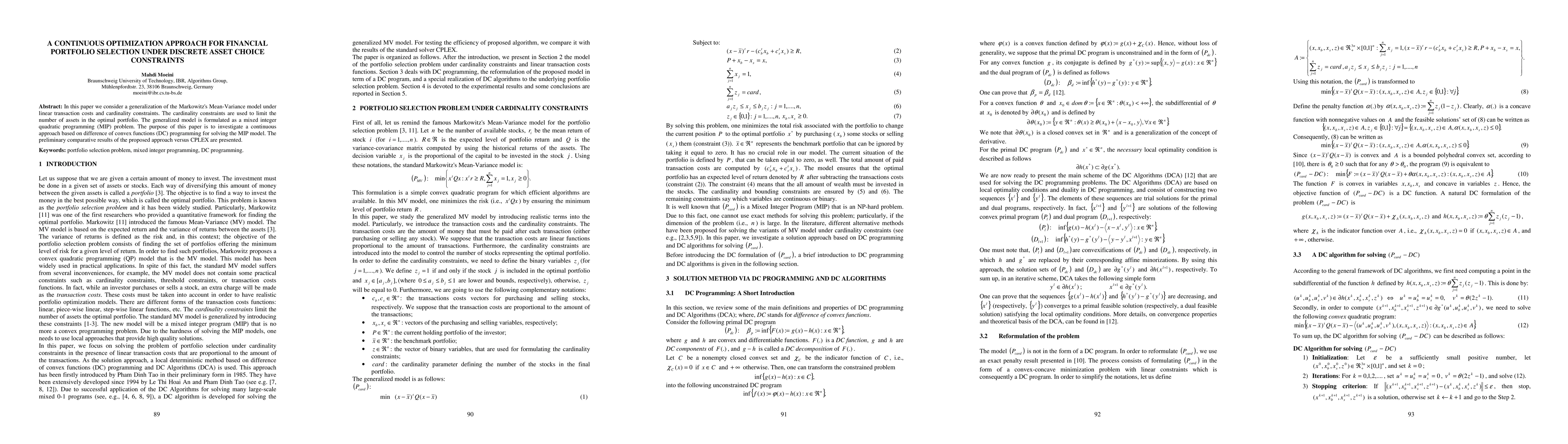

In this paper we consider a generalization of the Markowitz's Mean-Variance model under linear transaction costs and cardinality constraints. The cardinality constraints are used to limit the number of assets in the optimal portfolio. The generalized model is formulated as a mixed integer quadratic programming (MIP) problem. The purpose of this paper is to investigate a continuous approach based on difference of convex functions (DC) programming for solving the MIP model. The preliminary comparative results of the proposed approach versus CPLEX are presented.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Martingale approach to continuous Portfolio Optimization under CVaR like constraints

Jérôme Lelong, Véronique Maume-Deschamps, William Thevenot

The Exploratory Multi-Asset Mean-Variance Portfolio Selection using Reinforcement Learning

Yu Li, Yuhan Wu, Shuhua Zhang

No citations found for this paper.

Comments (0)