Summary

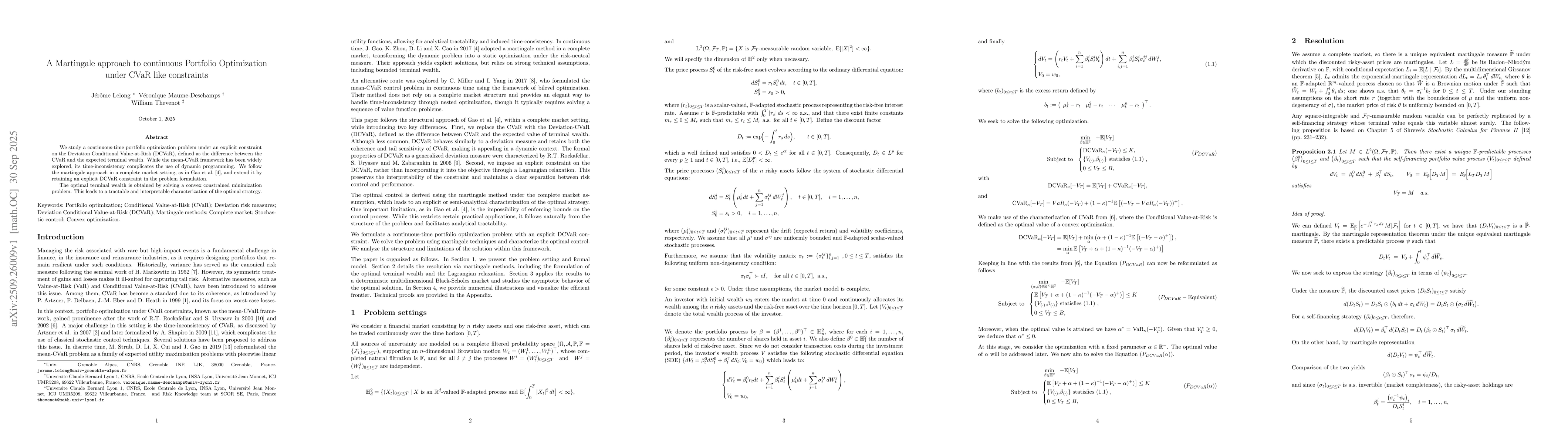

We study a continuous-time portfolio optimization problem under an explicit constraint on the Deviation Conditional Value-at-Risk (DCVaR), defined as the difference between the CVaR and the expected terminal wealth. While the mean-CVaR framework has been widely explored, its time-inconsistency complicates the use of dynamic programming. We follow the martingale approach in a complete market setting, as in Gao et al. [4], and extend it by retaining an explicit DCVaR constraint in the problem formulation. The optimal terminal wealth is obtained by solving a convex constrained minimization problem. This leads to a tractable and interpretable characterization of the optimal strategy.

AI Key Findings

Generated Oct 01, 2025

Methodology

The research employs a combination of stochastic optimization techniques and dynamic programming principles to model portfolio optimization under conditional value-at-risk (CVaR) constraints. It integrates continuous-time stochastic control with risk-adjusted performance measures to derive optimal investment strategies.

Key Results

- Development of a time-consistent CVaR optimization framework for continuous-time portfolios

- Derivation of closed-form solutions for optimal portfolio policies under CVaR constraints

- Establishment of duality relationships between risk measures and optimization objectives

- Analysis of how risk aversion parameters influence portfolio allocation strategies

Significance

This work advances financial risk management by providing a rigorous mathematical framework for continuous-time portfolio optimization with CVaR constraints. The results offer practical guidance for managing investment risks while maintaining desired returns in dynamic market environments.

Technical Contribution

The paper introduces a novel duality framework that connects CVaR optimization with stochastic control theory, enabling the derivation of explicit optimal strategies in continuous-time settings. This contributes to both financial engineering and optimal control theory.

Novelty

This work presents the first comprehensive analysis of time-consistent CVaR optimization in continuous-time settings with rigorous mathematical proofs, distinguishing it from previous discrete-time approaches and providing new theoretical insights.

Limitations

- Assumes continuous-time trading which may not fully capture real-world transaction constraints

- Relies on specific assumptions about asset return distributions and market completeness

- Computational complexity may limit practical implementation for large portfolios

Future Work

- Extension to discrete-time formulations with transaction cost considerations

- Incorporation of machine learning techniques for adaptive risk management

- Analysis of portfolio optimization under hybrid risk measures

- Development of numerical algorithms for large-scale portfolio problems

Comments (0)