Authors

Summary

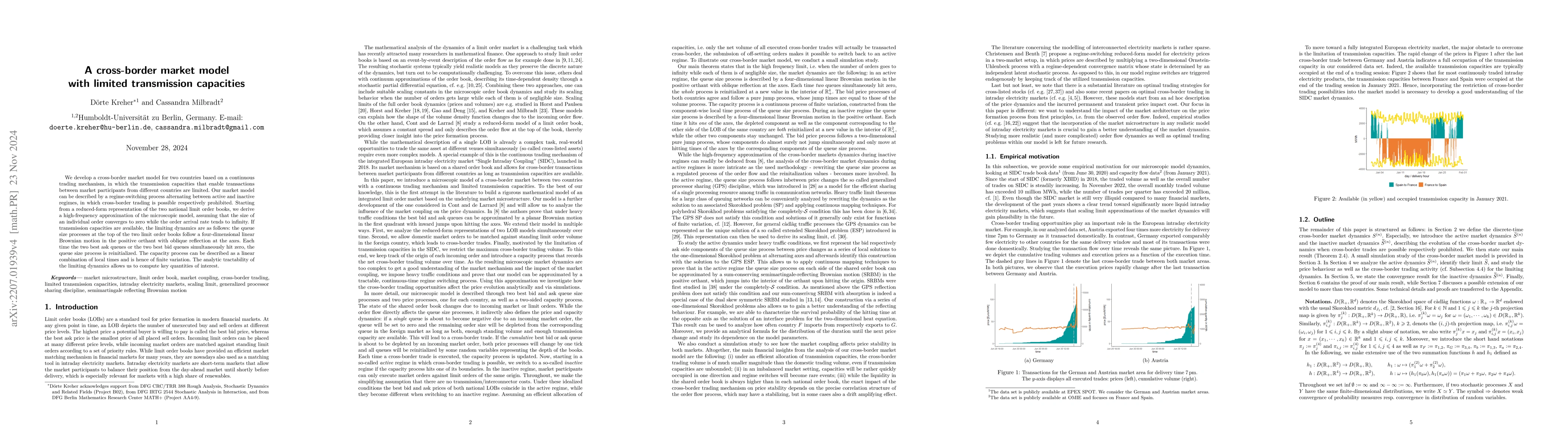

We develop a cross-border market model between two countries in which the transmission capacities that enable transactions between market participants of different countries are limited. Starting from two reduced-form representations of national limit order book dynamics, we allow incoming market orders to be matched with standing volumes of the foreign market, resulting in cross-border trades. Since the transmission capacities in our model are limited, our model alternates between regimes in which cross-border trades are possible and regimes in which incoming market orders can only be matched against limit orders of the same origin. We derive a high-frequency approximation of our microscopic model, assuming that the size of an individual order converges to zero while the order arrival rate tends to infinity. If transmission capacities are available, the limit process behaves as follows: the volume dynamics is a four-dimensional linear Brownian motion in the positive orthant with oblique reflection at the axes. Each time two queues simultaneously hit zero, the process is reinitialized. The capacity turns out to be a continuous process of finite variation. The analytic tractability of the limiting dynamics allows us to compute key quantities of interest like the distribution of the duration until the next price change. Additionally, we study the effect of cross-border trading on price stability through a simulation study.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEstimating cross-border mobility from the difference in peak-timing: A case study in Poland-Germany border regions

Justin M. Calabrese, Abhishek Senapati, Adam Mertel et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)