Summary

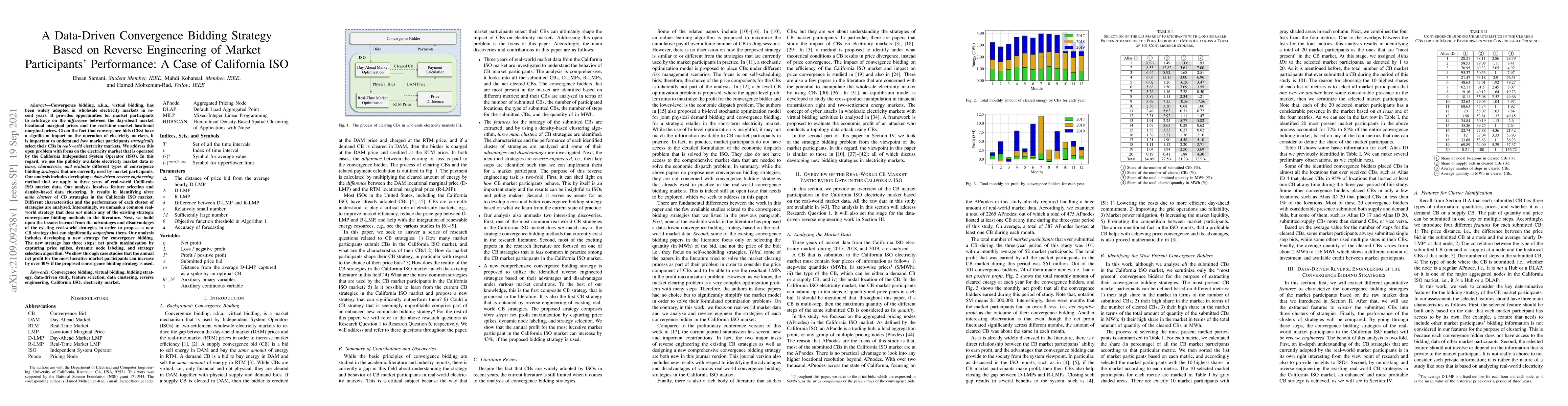

Convergence bidding, a.k.a., virtual bidding, has been widely adopted in wholesale electricity markets in recent years. It provides opportunities for market participants to arbitrage on the difference between the day-ahead market locational marginal prices and the real-time market locational marginal prices. Given the fact that convergence bids (CBs) have a significant impact on the operation of electricity markets, it is important to understand how market participants strategically select their CBs in real-world. We address this open problem with focus on the electricity market that is operated by the California ISO. In this regard, we use the publicly available electricity market data to learn, characterize, and evaluate different types of convergence bidding strategies that are currently used by market participants. Our analysis includes developing a data-driven reverse engineering method that we apply to three years of real-world data. Our analysis involves feature selection and density-based data clustering. It results in identifying three main clusters of CB strategies in the California ISO market. Different characteristics and the performance of each cluster of strategies are analyzed. Interestingly, we unmask a common real-world strategy that does not match any of the existing strategic convergence bidding methods in the literature. Next, we build upon the lessons learned from the existing real-world strategies to propose a new CB strategy that can significantly outperform them. Our analysis includes developing a new strategy for convergence bidding. The new strategy has three steps: net profit maximization by capturing price spikes, dynamic node labeling, and strategy selection algorithm. We show through case studies that the annual net profit for the most lucrative market participants can increase by over 40% if the proposed convergence bidding strategy is used.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA General Stochastic Optimization Framework for Convergence Bidding

Sean Lovett, Letif Mones

Data-Driven Online Interactive Bidding Strategy for Demand Response

Kuan-Cheng Lee, Wenjun Tang, Hong-Tzer Yang

| Title | Authors | Year | Actions |

|---|

Comments (0)