Summary

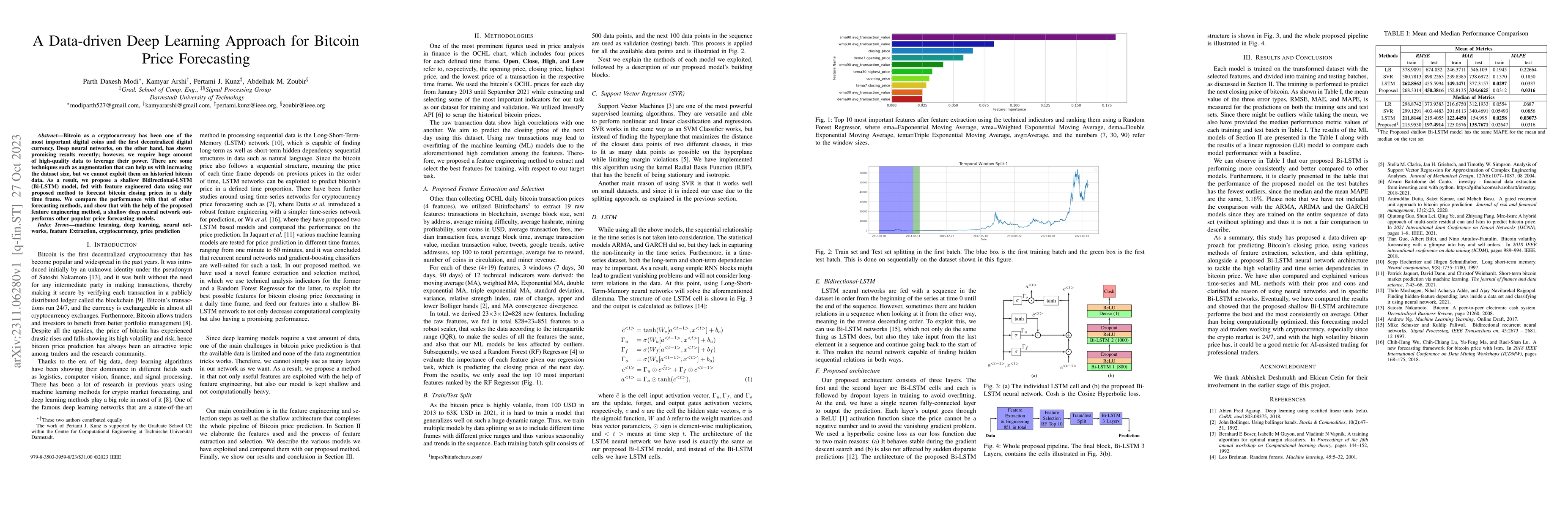

Bitcoin as a cryptocurrency has been one of the most important digital coins and the first decentralized digital currency. Deep neural networks, on the other hand, has shown promising results recently; however, we require huge amount of high-quality data to leverage their power. There are some techniques such as augmentation that can help us with increasing the dataset size, but we cannot exploit them on historical bitcoin data. As a result, we propose a shallow Bidirectional-LSTM (Bi-LSTM) model, fed with feature engineered data using our proposed method to forecast bitcoin closing prices in a daily time frame. We compare the performance with that of other forecasting methods, and show that with the help of the proposed feature engineering method, a shallow deep neural network outperforms other popular price forecasting models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBitcoin Transaction Forecasting with Deep Network Representation Learning

Qi Zhang, Ling Liu, Wenqi Wei

A Machine Learning Approach For Bitcoin Forecasting

Gissel Velarde, Stefano Sossi-Rojas, Damian Zieba

Forecasting of Bitcoin Prices Using Hashrate Features: Wavelet and Deep Stacking Approach

Ramin Mousa, Hooman Khaloo, Meysam Afrookhteh et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)