Summary

Bitcoin is one of the cryptocurrencies that is gaining more popularity in recent years. Previous studies have shown that closing price alone is not enough to forecast stock market series. We introduce a new set of time series and demonstrate that a subset is necessary to improve directional accuracy based on a machine learning ensemble. In our experiments, we study which time series and machine learning algorithms deliver the best results. We found that the most relevant time series that contribute to improving directional accuracy are Open, High and Low, with the largest contribution of Low in combination with an ensemble of Gated Recurrent Unit network and a baseline forecast. The relevance of other Bitcoin-related features that are not price-related is negligible. The proposed method delivers similar performance to the state-of-the-art when observing directional accuracy.

AI Key Findings

Generated Jun 09, 2025

Methodology

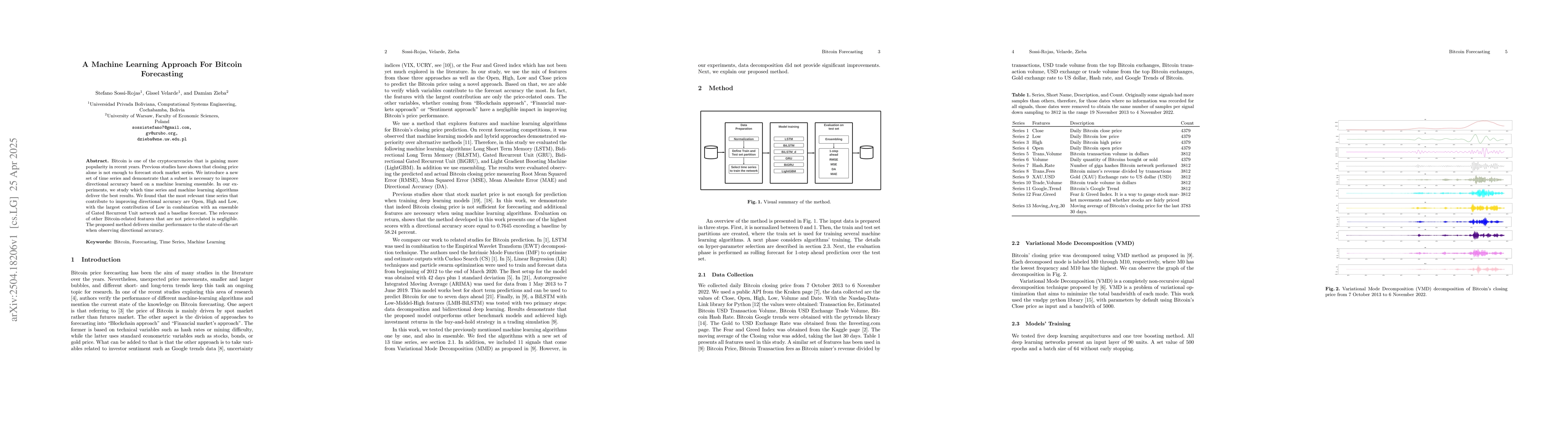

The research employs a machine learning ensemble approach using time series data, including Open, High, Low, and Volume, to forecast Bitcoin closing prices. Various models like LSTM, BiLSTM, GRU, BiGRU, and LightGBM are tested and compared.

Key Results

- The most relevant time series for improving directional accuracy are Open, High, and Low, with Low having the largest contribution.

- An ensemble of Gated Recurrent Unit (GRU) network and a baseline forecast delivers similar performance to the state-of-the-art in directional accuracy.

- GRU with Open, High, and Low values as input achieves the best Directional Accuracy (DA) of 0.7865, outperforming other models and baseline.

Significance

This research is significant as it confirms that Bitcoin price prediction requires more than just closing prices, demonstrating the importance of a subset of time series features for improved accuracy.

Technical Contribution

The paper presents a robust machine learning ensemble approach for Bitcoin price forecasting, emphasizing the importance of specific time series features and demonstrating the effectiveness of GRU in combination with a baseline forecast.

Novelty

This work distinguishes itself by focusing on the relevance of non-price related Bitcoin features and the successful application of GRU in conjunction with a baseline forecast for improved directional accuracy.

Limitations

- The study is limited to Bitcoin data from Kraken API, potentially affecting generalizability to other cryptocurrencies or exchanges.

- Performance evaluation is based on a specific time range, which may not guarantee consistent results across different market conditions.

Future Work

- Further exploration of additional cryptocurrencies and exchanges to validate the findings.

- Investigating the impact of incorporating more diverse features, such as social media sentiment or regulatory news, on prediction accuracy.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Data-driven Deep Learning Approach for Bitcoin Price Forecasting

Abdelhak M. Zoubir, Parth Daxesh Modi, Kamyar Arshi et al.

Bitcoin Transaction Forecasting with Deep Network Representation Learning

Qi Zhang, Ling Liu, Wenqi Wei

Forecasting the movements of Bitcoin prices: an application of machine learning algorithms

Hakan Pabuccu, Serdar Ongan, Ayse Ongan

| Title | Authors | Year | Actions |

|---|

Comments (0)