Summary

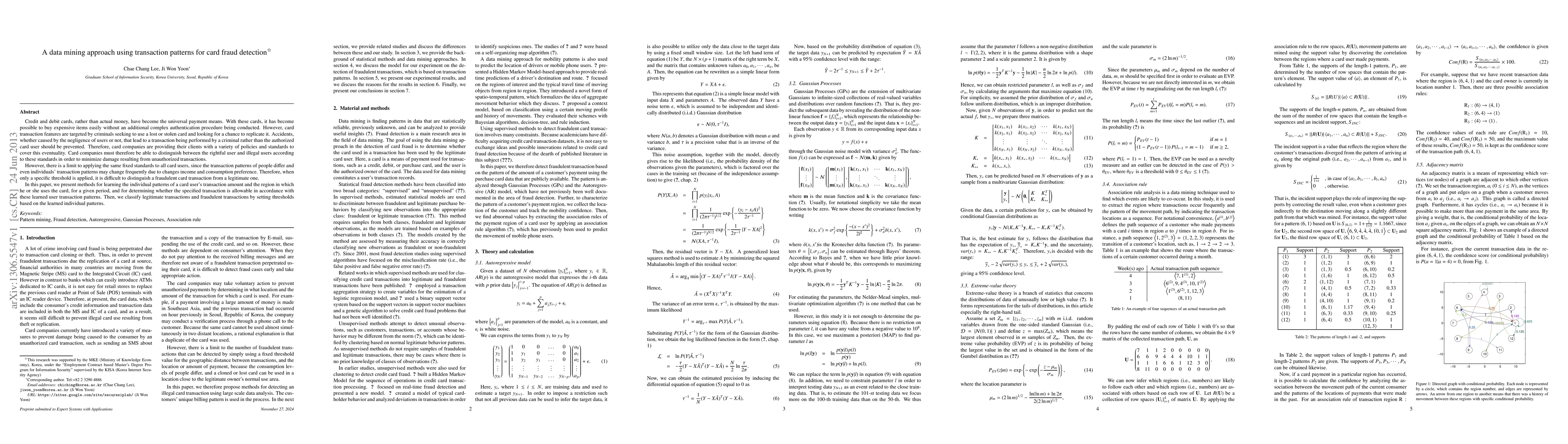

Credit and debit cards, rather than actual money, have become the universal payment means. With these cards, it has become possible to buy expensive items easily without an additional complex authentication procedure being conducted. However, card transaction features are targeted by criminals seeking to use a lost or stolen card and looking for a chance to replicate it. Accidents, whether caused by the negligence of users or not, that lead to a transaction being performed by a criminal rather than the authorized card user should be prevented. Therefore, card companies are providing their clients with a variety of policies and standards to cover this eventuality. Card companies must therefore be able to distinguish between the rightful user and illegal users according to these standards in order to minimize damage resulting from unauthorized transactions. However, there is a limit to applying the same fixed standards to all card users, since the transaction patterns of people differ and even individuals' transaction patterns may change frequently due to changes income and consumption preference. Therefore, when only a specific threshold is applied, it is difficult to distinguish a fraudulent card transaction from a legitimate one. In this paper, we present methods for learning the individual patterns of a card user's transaction amount and the region in which he or she uses the card, for a given period, and for determining whether the specified transaction is allowable in accordance with these learned user transaction patterns. Then, we classify legitimate transactions and fraudulent transactions by setting thresholds based on the learned individual patterns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCredit Card Fraud Detection: A Deep Learning Approach

Sourav Verma, Joydip Dhar

Synthetic Demographic Data Generation for Card Fraud Detection Using GANs

Shuo Wang, Xianta Jiang, Terrence Tricco et al.

Credit Card Fraud Detection Using Enhanced Random Forest Classifier for Imbalanced Data

Huthaifa I. Ashqar, AlsharifHasan Mohamad Aburbeian

| Title | Authors | Year | Actions |

|---|

Comments (0)