Authors

Summary

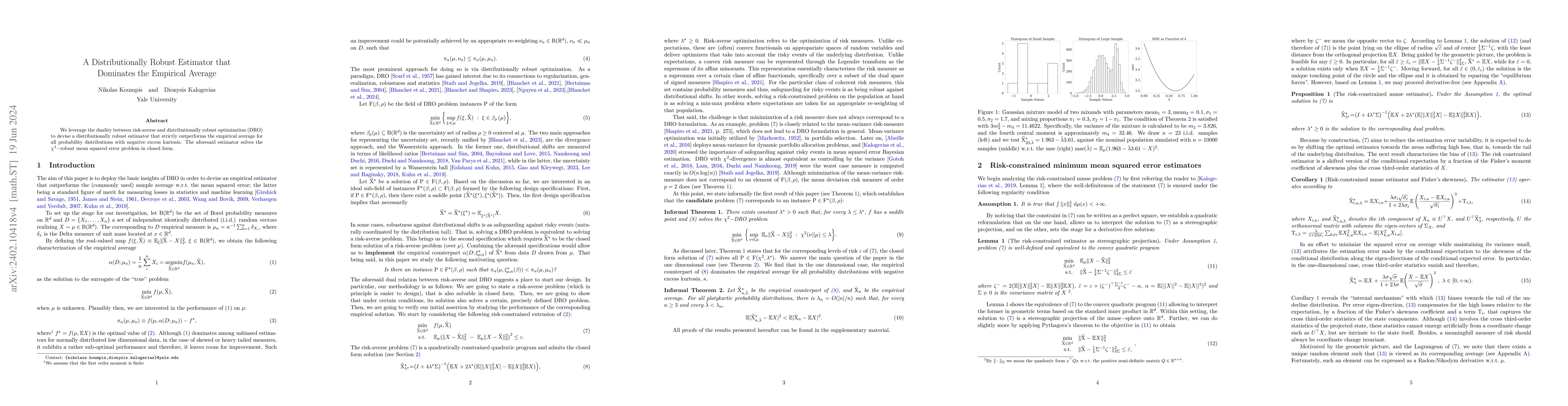

We leverage the duality between risk-averse and distributionally robust optimization (DRO) to devise a distributionally robust estimator that strictly outperforms the empirical average for all probability distributions with negative excess kurtosis. The aforesaid estimator solves the $\chi^{2}-$robust mean squared error problem in closed form.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)