Authors

Summary

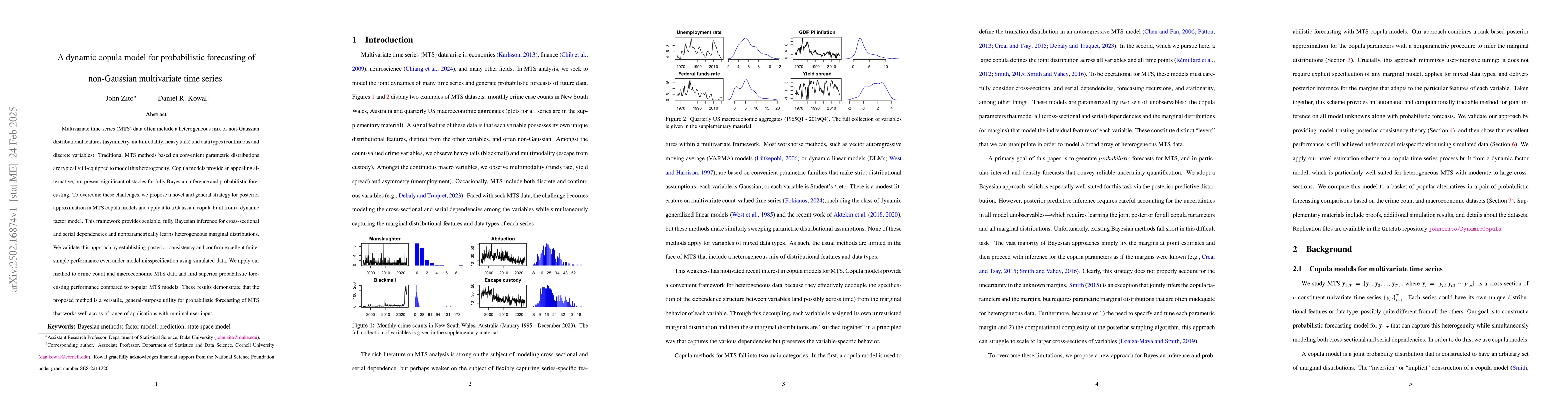

Multivariate time series (MTS) data often include a heterogeneous mix of non-Gaussian distributional features (asymmetry, multimodality, heavy tails) and data types (continuous and discrete variables). Traditional MTS methods based on convenient parametric distributions are typically ill-equipped to model this heterogeneity. Copula models provide an appealing alternative, but present significant obstacles for fully Bayesian inference and probabilistic forecasting. To overcome these challenges, we propose a novel and general strategy for posterior approximation in MTS copula models and apply it to a Gaussian copula built from a dynamic factor model. This framework provides scalable, fully Bayesian inference for cross-sectional and serial dependencies and nonparametrically learns heterogeneous marginal distributions. We validate this approach by establishing posterior consistency and confirm excellent finite-sample performance even under model misspecification using simulated data. We apply our method to crime count and macroeconomic MTS data and find superior probabilistic forecasting performance compared to popular MTS models. These results demonstrate that the proposed method is a versatile, general-purpose utility for probabilistic forecasting of MTS that works well across of range of applications with minimal user input.

AI Key Findings

Generated Jun 11, 2025

Methodology

The research proposes a novel posterior approximation strategy for multivariate time series (MTS) copula models, applied to a Gaussian copula built from a dynamic factor model. This framework provides scalable, fully Bayesian inference for cross-sectional and serial dependencies and nonparametrically learns heterogeneous marginal distributions.

Key Results

- The proposed method establishes posterior consistency and demonstrates excellent finite-sample performance even under model misspecification using simulated data.

- Superior probabilistic forecasting performance is found compared to popular MTS models on crime count and macroeconomic MTS data.

- The method is versatile and general-purpose, working well across a range of applications with minimal user input.

Significance

This research is significant as it addresses the limitations of traditional MTS methods based on convenient parametric distributions, which are often ill-equipped to model heterogeneous mixes of non-Gaussian distributional features and data types.

Technical Contribution

The paper introduces a general strategy for posterior approximation in MTS copula models, enabling scalable, fully Bayesian inference for various dependencies and heterogeneous marginal distributions.

Novelty

The proposed method stands out by overcoming the challenges of fully Bayesian inference and probabilistic forecasting in copula models, providing a flexible and practical solution for diverse MTS data.

Limitations

- Theoretical results assume model correctness, including the MTS copula model and specific latent dynamics.

- Results currently use continuous marginals, though empirical evaluations with simulated and real data consider misspecified models with continuous and discrete MTS data.

Future Work

- Extend the approach for binary and categorical variables, for instance, by replacing the rank posterior approximation with a rank-probit posterior.

- Incorporate non-stationary dynamics in (3) with a more general link (2), which would require careful modification of the margin adjustment.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLatent Gaussian dynamic factor modeling and forecasting for multivariate count time series

Marie-Christine Düker, Vladas Pipiras, Younghoon Kim et al.

No citations found for this paper.

Comments (0)