Summary

We propose a dynamic network model where two mechanisms control the probability of a link between two nodes: (i) the existence or absence of this link in the past, and (ii) node-specific latent variables (dynamic fitnesses) describing the propensity of each node to create links. Assuming a Markov dynamics for both mechanisms, we propose an Expectation-Maximization algorithm for model estimation and inference of the latent variables. The estimated parameters and fitnesses can be used to forecast the presence of a link in the future. We apply our methodology to the e-MID interbank network for which the two linkage mechanisms are associated with two different trading behaviors in the process of network formation, namely preferential trading and trading driven by node-specific characteristics. The empirical results allow to recognise preferential lending in the interbank market and indicate how a method that does not account for time-varying network topologies tends to overestimate preferential linkage.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

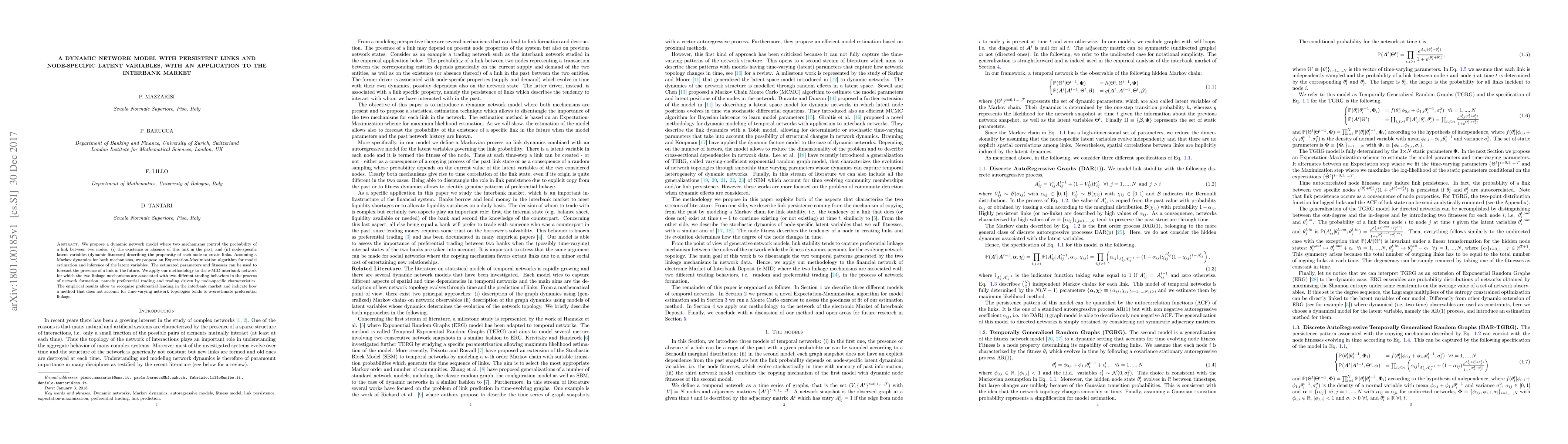

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)