Authors

Summary

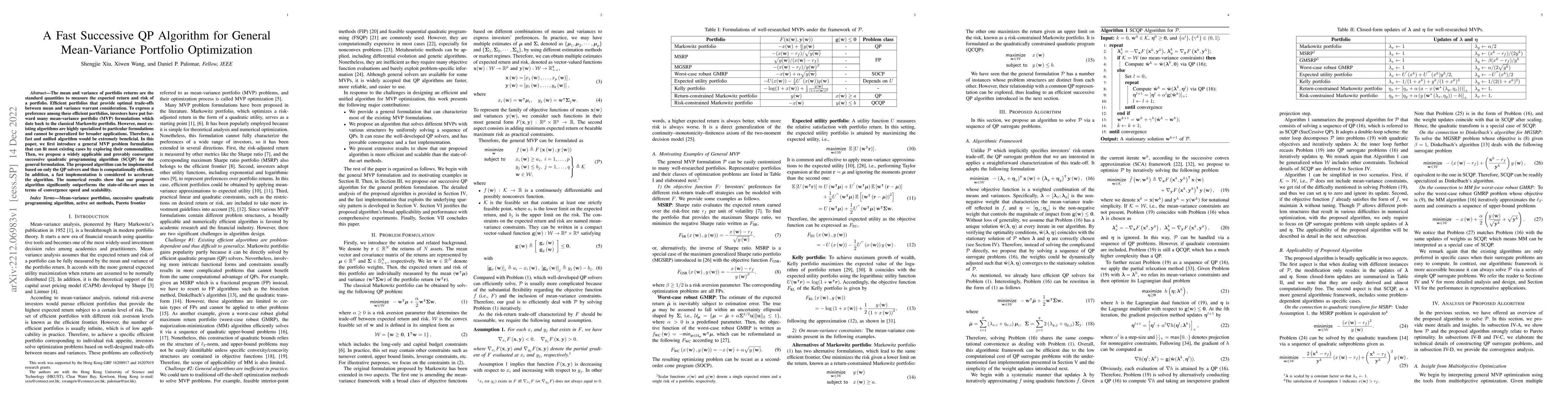

The mean and variance of portfolio returns are the standard quantities to measure the expected return and risk of a portfolio. Efficient portfolios that provide optimal trade-offs between mean and variance warrant consideration. To express a preference among these efficient portfolios, investors have put forward many mean-variance portfolio (MVP) formulations which date back to the classical Markowitz portfolio. However, most existing algorithms are highly specialized to particular formulations and cannot be generalized for broader applications. Therefore, a fast and unified algorithm would be extremely beneficial. In this paper, we first introduce a general MVP problem formulation that can fit most existing cases by exploring their commonalities. Then, we propose a widely applicable and provably convergent successive quadratic programming algorithm (SCQP) for the general formulation. The proposed algorithm can be implemented based on only the QP solvers and thus is computationally efficient. In addition, a fast implementation is considered to accelerate the algorithm. The numerical results show that our proposed algorithm significantly outperforms the state-of-the-art ones in terms of convergence speed and scalability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIntegrating prediction in mean-variance portfolio optimization

Andrew Butler, Roy H. Kwon

Deep Reinforcement Learning and Mean-Variance Strategies for Responsible Portfolio Optimization

Manuela Veloso, Fernando Acero, Parisa Zehtabi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)