Summary

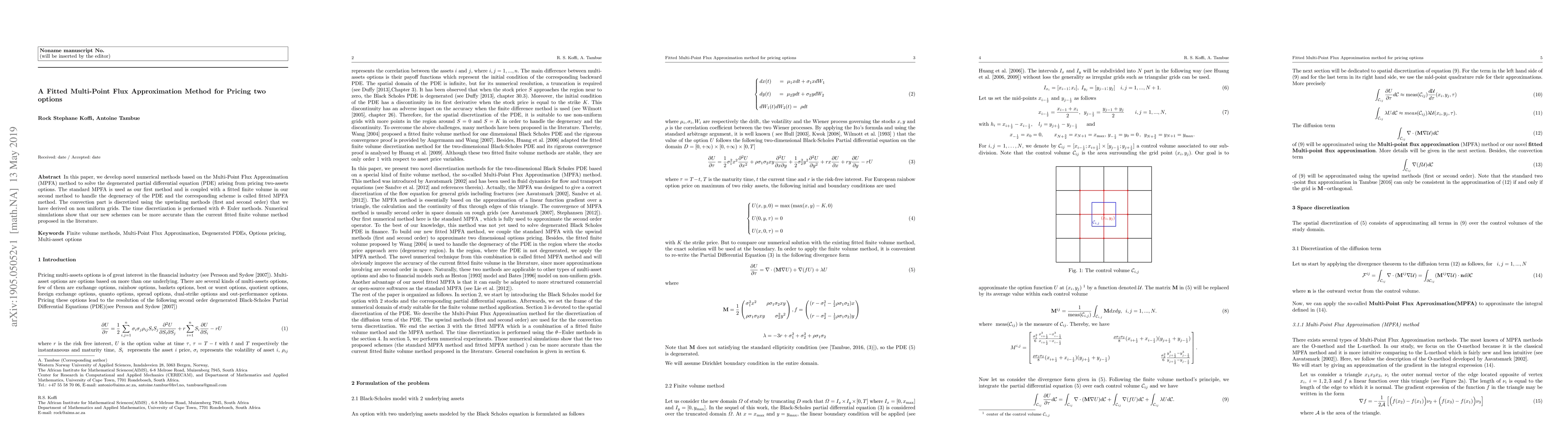

In this paper, we develop novel numerical methods based on the Multi-Point Flux Approximation (MPFA) method to solve the degenerated partial differential equation (PDE) arising from pricing two-assets options. The standard MPFA is used as our first method and is coupled with a fitted finite volume in our second method to handle the degeneracy of the PDE and the corresponding scheme is called fitted MPFA method. The convection part is discretized using the upwinding methods (first and second order) that we have derived on non uniform grids. The time discretization is performed with $\theta$- Euler methods. Numerical simulations show that our new schemes can be more accurate than the current fitted finite volume method proposed in the literature.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)