Authors

Summary

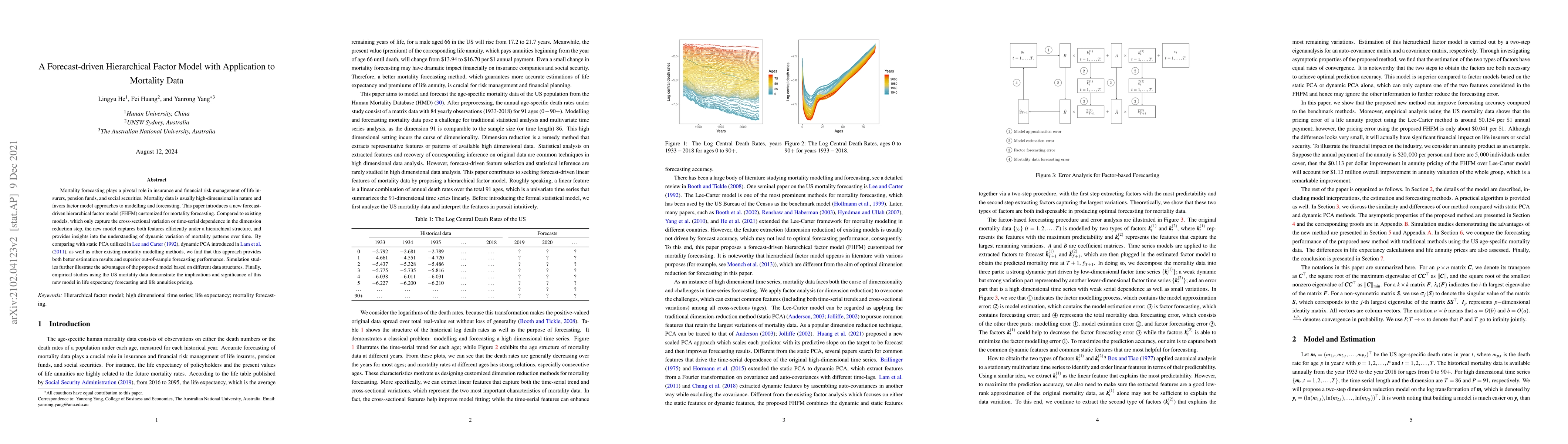

Mortality forecasting plays a pivotal role in insurance and financial risk management of life insurers, pension funds, and social securities. Mortality data is usually high-dimensional in nature and favors factor model approaches to modelling and forecasting. This paper introduces a new forecast-driven hierarchical factor model (FHFM) customized for mortality forecasting. Compared to existing models, which only capture the cross-sectional variation or time-serial dependence in the dimension reduction step, the new model captures both features efficiently under a hierarchical structure, and provides insights into the understanding of dynamic variation of mortality patterns over time. By comparing with static PCA utilized in Lee and Carter 1992, dynamic PCA introduced in Lam et al. 2011, as well as other existing mortality modelling methods, we find that this approach provides both better estimation results and superior out-of-sample forecasting performance. Simulation studies further illustrate the advantages of the proposed model based on different data structures. Finally, empirical studies using the US mortality data demonstrate the implications and significance of this new model in life expectancy forecasting and life annuities pricing.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)