Summary

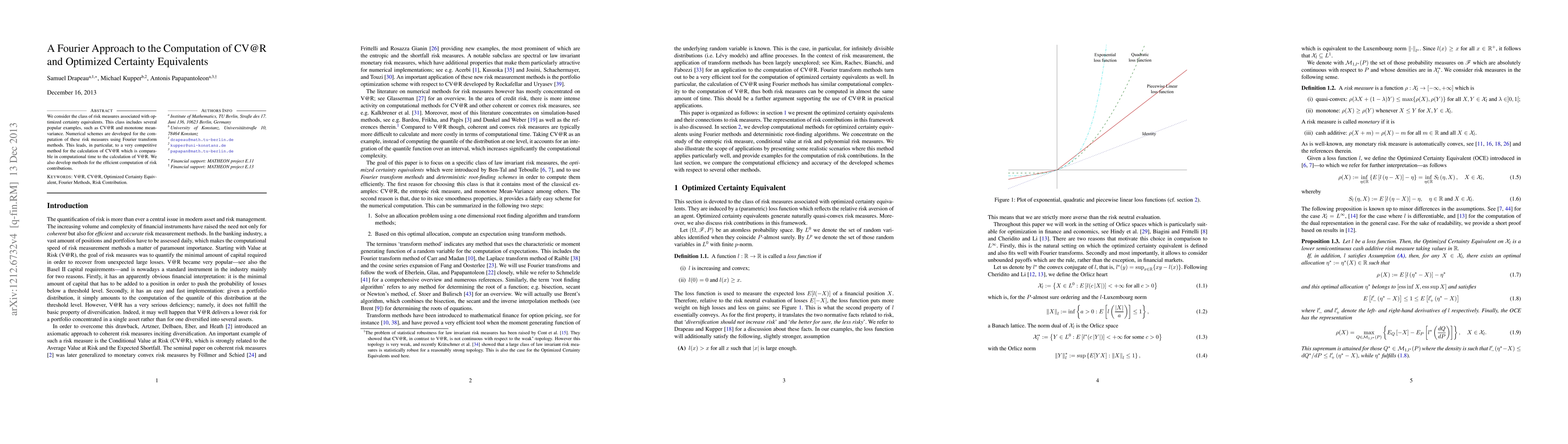

We consider the class of risk measures associated with optimized certainty equivalents. This class includes several popular examples, such as CV@R and monotone mean-variance. Numerical schemes are developed for the computation of these risk measures using Fourier transform methods. This leads, in particular, to a very competitive method for the calculation of CV@R which is comparable in computational time to the calculation of V@R. We also develop methods for the efficient computation of risk contributions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStochastic control of optimized certainty equivalents

Ludovic Tangpi, A. Max Reppen, Julio Backhoff Veraguas

Robust optimized certainty equivalents and quantiles for loss positions with distribution uncertainty

Weiwei Li, Dejian Tian

Multivariate Optimized Certainty Equivalent Risk Measures and their Numerical Computation

Anis Matoussi, Sarah Kaakai, Achraf Tamtalini

| Title | Authors | Year | Actions |

|---|

Comments (0)