Summary

Optimized certainty equivalents (OCEs) is a family of risk measures widely used by both practitioners and academics. This is mostly due to its tractability and the fact that it encompasses important examples, including entropic risk measures and average value at risk. In this work we consider stochastic optimal control problems where the objective criterion is given by an OCE risk measure, or put in other words, a risk minimization problem for controlled diffusions. A major difficulty arises since OCEs are often time inconsistent. Nevertheless, via an enlargement of state space we achieve a substitute of sorts for time consistency in fair generality. This allows us to derive a dynamic programming principle and thus recover central results of (risk-neutral) stochastic control theory. In particular, we show that the value of our risk minimization problem can be characterized via the viscosity solution of a Hamilton--Jacobi--Bellman--Issacs equation. We further establish the uniqueness of the latter under suitable technical conditions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

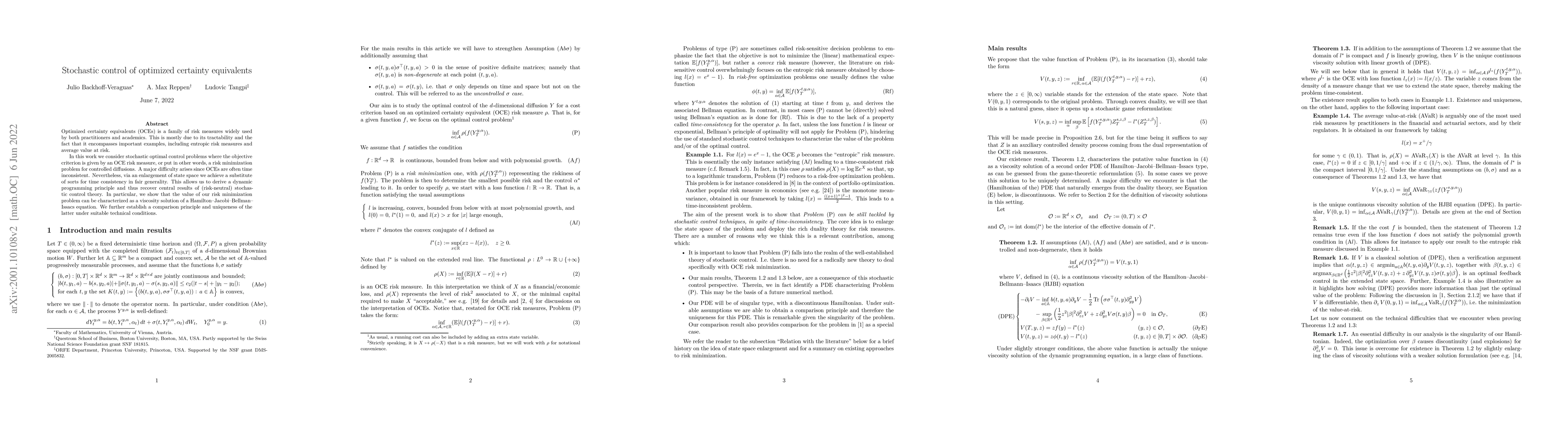

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust optimized certainty equivalents and quantiles for loss positions with distribution uncertainty

Weiwei Li, Dejian Tian

Regret Bounds for Markov Decision Processes with Recursive Optimized Certainty Equivalents

Wenhao Xu, Xuefeng Gao, Xuedong He

| Title | Authors | Year | Actions |

|---|

Comments (0)