Summary

Spread options are a fundamental class of derivative contract written on multiple assets, and are widely used in a range of financial markets. There is a long history of approximation methods for computing such products, but as yet there is no preferred approach that is accurate, efficient and flexible enough to apply in general models. The present paper introduces a new formula for general spread option pricing based on Fourier analysis of the spread option payoff function. Our detailed investigation proves the effectiveness of a fast Fourier transform implementation of this formula for the computation of prices. It is found to be easy to implement, stable, efficient and applicable in a wide variety of asset pricing models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

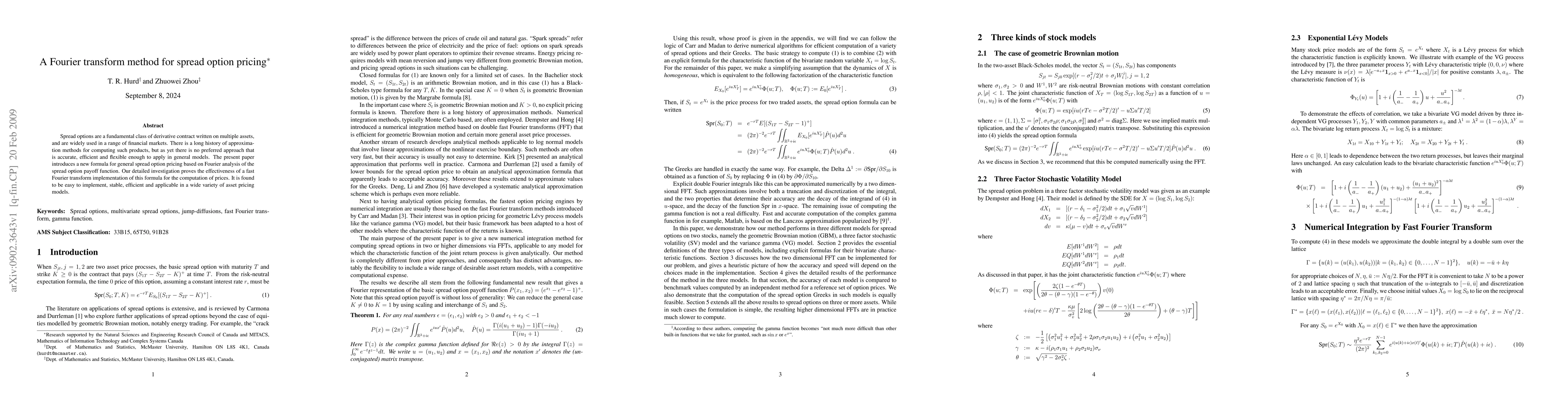

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLearning parameter dependence for Fourier-based option pricing with tensor trains

Koichi Miyamoto, Rihito Sakurai, Haruto Takahashi

| Title | Authors | Year | Actions |

|---|

Comments (0)