Authors

Summary

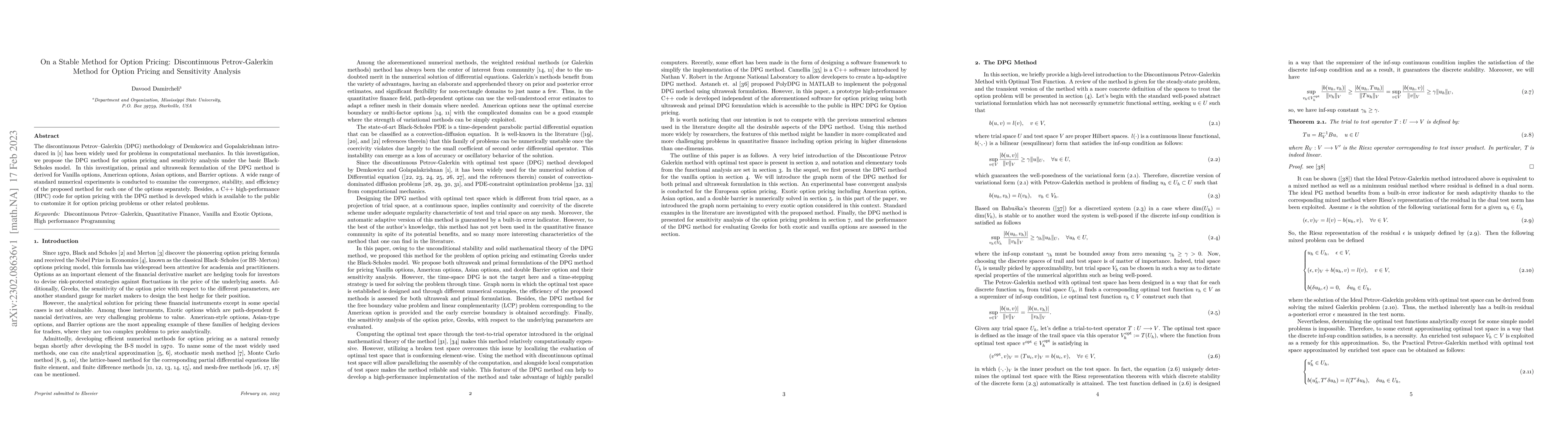

The discontinuous Petrov Galerkin (DPG) methodology of Demkowicz and Gopalakrishnan introduced in their first paper has been widely used for problems in computational mechanics. In this investigation, we propose the DPG method for option pricing and sensitivity analysis under the basic Black-Scholes model. In this investigation, primal and ultra-weak formulation of the DPG method is derived for Vanilla options, American options, Asian options, and Barrier options. A wide range of standard numerical experiments is conducted to examine the convergence, stability, and efficiency of the proposed method for each one of the options separately. Besides, a C++ high performance (HPC) code for option pricing with the DPG method is developed which is available to the public to customize it for option pricing problems or other related problems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)