Authors

Summary

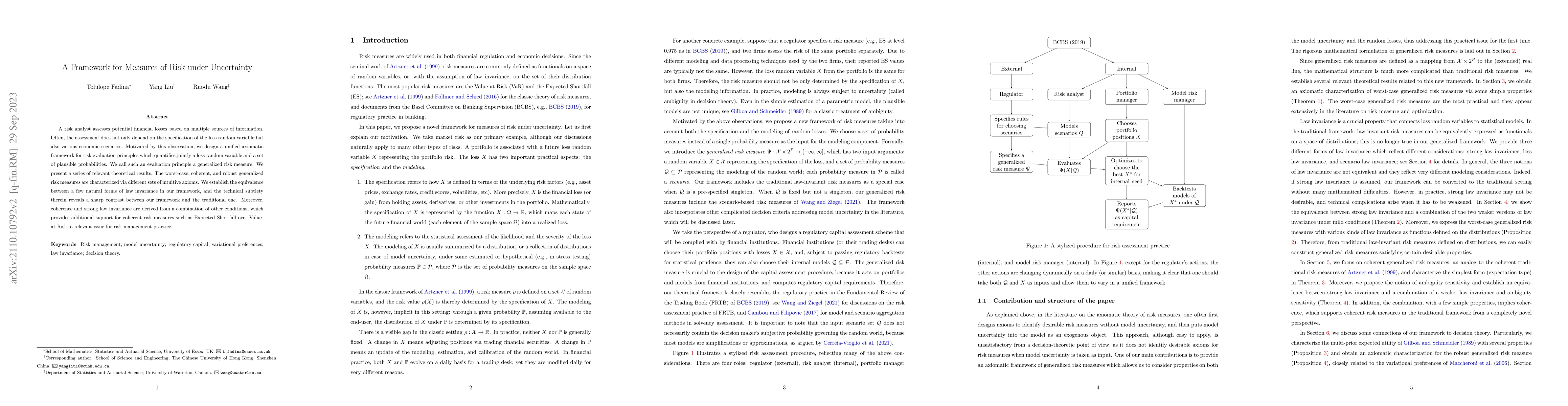

A risk analyst assesses potential financial losses based on multiple sources of information. Often, the assessment does not only depend on the specification of the loss random variable but also various economic scenarios. Motivated by this observation, we design a unified axiomatic framework for risk evaluation principles which quantifies jointly a loss random variable and a set of plausible probabilities. We call such an evaluation principle a generalized risk measure. We present a series of relevant theoretical results. The worst-case, coherent, and robust generalized risk measures are characterized via different sets of intuitive axioms. We establish the equivalence between a few natural forms of law invariance in our framework, and the technical subtlety therein reveals a sharp contrast between our framework and the traditional one. Moreover, coherence and strong law invariance are derived from a combination of other conditions, which provides additional support for coherent risk measures such as Expected Shortfall over Value-at-Risk, a relevant issue for risk management practice.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisk measures under model uncertainty: a Bayesian viewpoint

Guido Gazzani, Christa Cuchiero, Irene Klein

| Title | Authors | Year | Actions |

|---|

Comments (0)