Ruodu Wang

76 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Newsvendor under Mean-Variance Ambiguity and Misspecification

Consider a newsvendor problem with an unknown demand distribution. When addressing the issue of distributional uncertainty, we distinguish ambiguity under which the newsvendor does not differentiate...

Sub-uniformity of harmonic mean p-values

We obtain several inequalities on the generalized means of dependent p-values. In particular, the weighted harmonic mean of p-values is strictly sub-uniform under several dependence assumptions of p...

Dominance between combinations of infinite-mean Pareto random variables

We study stochastic dominance between portfolios of independent and identically distributed (iid) extremely heavy-tailed (i.e., infinite-mean) Pareto random variables. With the notion of majorizatio...

Duet expectile preferences

We introduce a novel axiom of co-loss aversion for a preference relation over the space of acts, represented by measurable functions on a suitable measurable space. This axiom means that the decisio...

The checkerboard copula and dependence concepts

We study the problem of choosing the copula when the marginal distributions of a random vector are not all continuous. Inspired by three motivating examples including simulation from copulas, stress...

Elicitability and identifiability of tail risk measures

Tail risk measures are fully determined by the distribution of the underlying loss beyond its quantile at a certain level, with Value-at-Risk and Expected Shortfall being prime examples. They are in...

Allocation Mechanisms in Decentralized Exchange Markets with Frictions

The classical theory of efficient allocations of an aggregate endowment in a pure-exchange economy has hitherto primarily focused on the Pareto-efficiency of allocations, under the implicit assumpti...

Coherent risk measures and uniform integrability

We establish a profound connection between coherent risk measures, a prominent object in quantitative finance, and uniform integrability, a fundamental concept in probability theory. Instead of work...

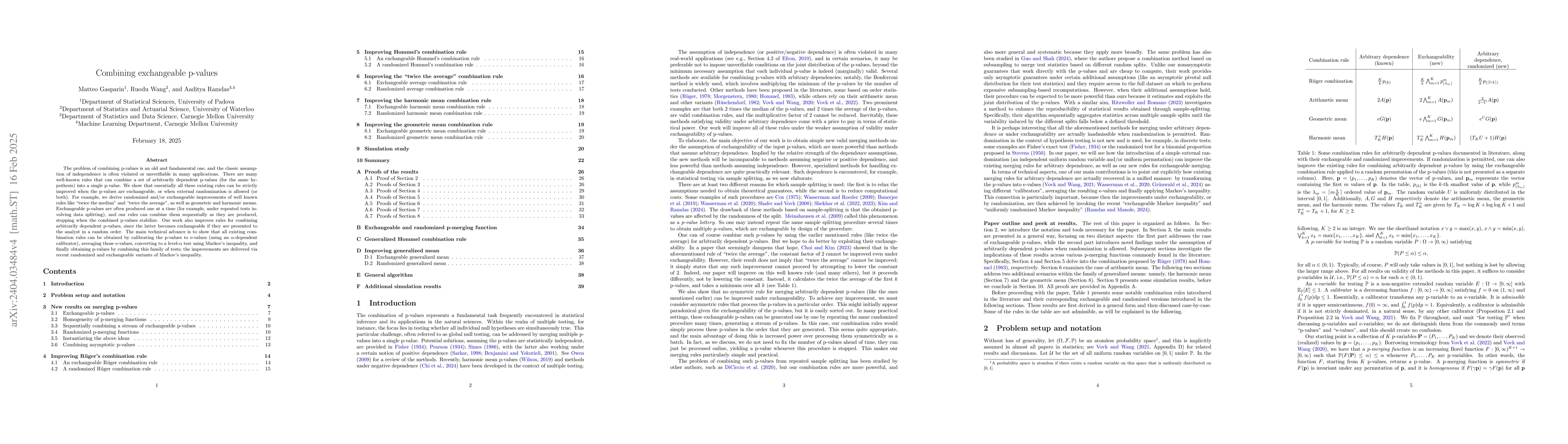

Combining exchangeable p-values

The problem of combining p-values is an old and fundamental one, and the classic assumption of independence is often violated or unverifiable in many applications. There are many well-known rules th...

Risk exchange under infinite-mean Pareto models

We study the optimal decisions of agents who aim to minimize their risks by allocating their positions over extremely heavy-tailed (i.e., infinite-mean) and possibly dependent losses. The loss distr...

Max-stability under first-order stochastic dominance

Max-stability is the property that taking a maximum between two inputs results in a maximum between two outputs. We investigate max-stability with respect to first-order stochastic dominance, the mo...

A new characterization of second-order stochastic dominance

We provide a new characterization of second-order stochastic dominance, also known as increasing concave order. The result has an intuitive interpretation that adding a risk with negative expected v...

Partial Law Invariance and Risk Measures

We introduce the concept of partial law invariance, generalizing the concepts of law invariance and probabilistic sophistication widely used in decision theory, as well as statistical and financial ...

Negatively dependent optimal risk sharing

We analyze the problem of optimally sharing risk using allocations that exhibit counter-monotonicity, the most extreme form of negative dependence. Counter-monotonic allocations take the form of eit...

Monotonic mean-deviation risk measures

Mean-deviation models, along with the existing theory of coherent risk measures, are well studied in the literature. In this paper, we characterize monotonic mean-deviation (risk) measures from a ge...

Risk Aversion and Insurance Propensity

We provide a new foundation of risk aversion by showing that the propension to exploit insurance opportunities fully describes this attitude. Our foundation, which applies to any probabilistically s...

A duality between utility transforms and probability distortions

In this paper, we establish a mathematical duality between utility transforms and probability distortions. These transforms play a central role in decision under risk by forming the foundation for t...

Distorted optimal transport

Classic optimal transport theory is built on minimizing the expected cost between two given distributions. We propose the framework of distorted optimal transport by minimizing a distorted expected ...

Invariant correlation under marginal transforms

A useful property of independent samples is that their correlation remains the same after applying marginal transforms. This invariance property plays a fundamental role in statistical inference, bu...

On the existence of powerful p-values and e-values for composite hypotheses

Given a composite null $ \mathcal P$ and composite alternative $ \mathcal Q$, when and how can we construct a p-value whose distribution is exactly uniform under the null, and stochastically smaller...

Composite Sorting

We propose a new sorting framework: composite sorting. Composite sorting comprises of (1) distinct worker types assigned to the same occupation, and (2) a given worker type simultaneously being part...

Pairwise counter-monotonicity

We systematically study pairwise counter-monotonicity, an extremal notion of negative dependence. A stochastic representation and an invariance property are established for this dependence structure...

Risk sharing, measuring variability, and distortion riskmetrics

We address the problem of sharing risk among agents with preferences modelled by a general class of comonotonic additive and law-based functionals that need not be either monotone or convex. Such fu...

Testing mean and variance by e-processes

We address the problem of testing conditional mean and conditional variance for non-stationary data. We build e-values and p-values for four types of non-parametric composite hypotheses with specifi...

Diversification quotients based on VaR and ES

The diversification quotient (DQ) is recently introduced for quantifying the degree of diversification of a stochastic portfolio model. It has an axiomatic foundation and can be defined through a pa...

Multiple testing under negative dependence

The multiple testing literature has primarily dealt with three types of dependence assumptions between p-values: independence, positive regression dependence, and arbitrary dependence. In this paper...

Martingale Transports and Monge Maps

It is well known that martingale transport plans between marginals $\mu\neq\nu$ are never given by Monge maps -- with the understanding that the map is over the first marginal $\mu$, or forward in t...

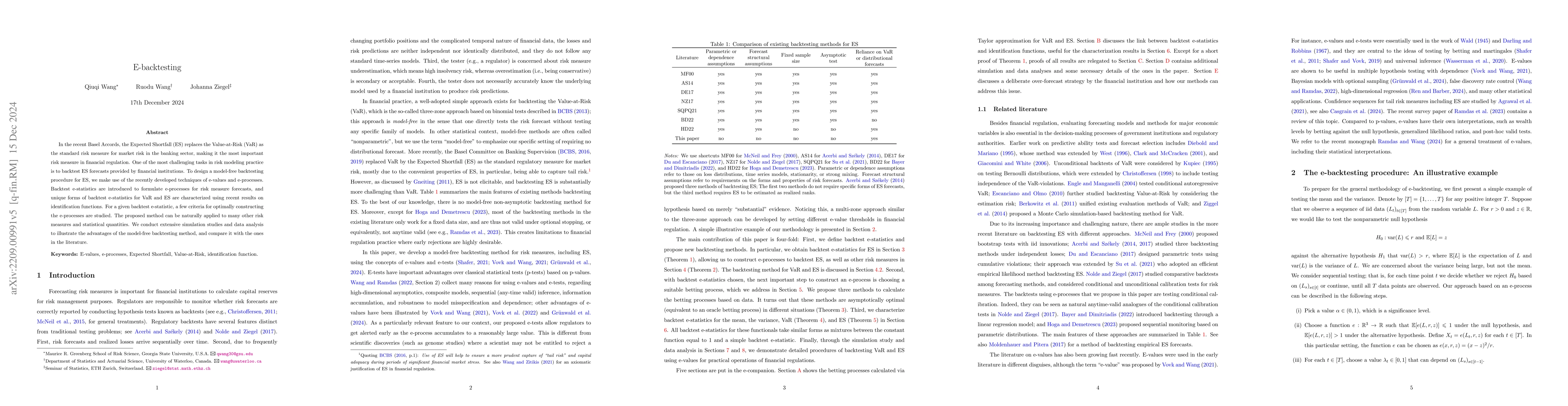

E-backtesting

In the recent Basel Accords, the Expected Shortfall (ES) replaces the Value-at-Risk (VaR) as the standard risk measure for market risk in the banking sector, making it the most important risk measur...

Efficiency of nonparametric e-tests

The notion of an e-value has been recently proposed as a possible alternative to critical regions and p-values in statistical hypothesis testing. In this paper we consider testing the nonparametric ...

Choquet regularization for reinforcement learning

We propose \emph{Choquet regularizers} to measure and manage the level of exploration for reinforcement learning (RL), and reformulate the continuous-time entropy-regularized RL problem of Wang et a...

An unexpected stochastic dominance: Pareto distributions, dependence, and diversification

We find the perhaps surprising inequality that the weighted average of independent and identically distributed Pareto random variables with infinite mean is larger than one such random variable in t...

An axiomatic theory for anonymized risk sharing

We study an axiomatic framework for anonymized risk sharing. In contrast to traditional risk sharing settings, our framework requires no information on preferences, identities, private operations an...

Diversification quotients: Quantifying diversification via risk measures

We establish the first axiomatic theory for diversification indices using six intuitive axioms: non-negativity, location invariance, scale invariance, rationality, normalization, and continuity. The...

E-values as unnormalized weights in multiple testing

We study how to combine p-values and e-values, and design multiple testing procedures where both p-values and e-values are available for every hypothesis. Our results provide a new perspective on mu...

Joint mixability and notions of negative dependence

A joint mix is a random vector with a constant component-wise sum. The dependence structure of a joint mix minimizes some common objectives such as the variance of the component-wise sum, and it is ...

Calibrating distribution models from PELVE

The Value-at-Risk (VaR) and the Expected Shortfall (ES) are the two most popular risk measures in banking and insurance regulation. To bridge between the two regulatory risk measures, the Probabilit...

Post-selection inference for e-value based confidence intervals

Suppose that one can construct a valid $(1-\delta)$-confidence interval (CI) for each of $K$ parameters of potential interest. If a data analyst uses an arbitrary data-dependent criterion to select ...

A reverse ES (CVaR) optimization formula

The celebrated Expected Shortfall (ES) optimization formula implies that ES at a fixed probability level is the minimum of a linear real function plus a scaled mean excess function. We establish a r...

Elementary proofs of several results on false discovery rate

We collect self-contained elementary proofs of four results in the literature on the false discovery rate of the Benjamini-Hochberg (BH) procedure for independent or positive-regression dependent p-...

Model Aggregation for Risk Evaluation and Robust Optimization

We introduce a new approach for prudent risk evaluation based on stochastic dominance, which will be called the model aggregation (MA) approach. In contrast to the classic worst-case risk (WR) appro...

Simultaneous Optimal Transport

We propose a general framework of mass transport between vector-valued measures, which will be called simultaneous optimal transport (SOT). The new framework is motivated by the need to transport re...

Cash-subadditive risk measures without quasi-convexity

In the literature of risk measures, cash subadditivity was proposed to replace cash additivity, motivated by the presence of stochastic or ambiguous interest rates and defaultable contingent claims....

A Framework for Measures of Risk under Uncertainty

A risk analyst assesses potential financial losses based on multiple sources of information. Often, the assessment does not only depend on the specification of the loss random variable but also vari...

Risk Concentration and the Mean-Expected Shortfall Criterion

Expected Shortfall (ES, also known as CVaR) is the most important coherent risk measure in finance, insurance, risk management, and engineering. Recently, Wang and Zitikis (2021) put forward four ec...

A unified framework for bandit multiple testing

In bandit multiple hypothesis testing, each arm corresponds to a different null hypothesis that we wish to test, and the goal is to design adaptive algorithms that correctly identify large set of in...

Optimal Insurance to Maximize RDEU Under a Distortion-Deviation Premium Principle

In this paper, we study an optimal insurance problem for a risk-averse individual who seeks to maximize the rank-dependent expected utility (RDEU) of her terminal wealth, and insurance is priced via...

Star-shaped Risk Measures

In this paper monetary risk measures that are positively superhomogeneous, called star-shaped risk measures, are characterized and their properties studied. The measures in this class, which arise w...

Parametric measures of variability induced by risk measures

We present a general framework for a comparative theory of variability measures, with a particular focus on the recently introduced one-parameter families of inter-Expected Shortfall differences and...

Optimizing distortion riskmetrics with distributional uncertainty

Optimization of distortion riskmetrics with distributional uncertainty has wide applications in finance and operations research. Distortion riskmetrics include many commonly applied risk measures an...

Testing with p*-values: Between p-values, mid p-values, and e-values

We introduce the notion of p*-values (p*-variables), which generalizes p-values (p-variables) in several senses. The new notion has four natural interpretations: operational, probabilistic, Bayesian...

False discovery rate control with e-values

E-values have gained attention as potential alternatives to p-values as measures of uncertainty, significance and evidence. In brief, e-values are realized by random variables with expectation at mo...

Convolution Bounds on Quantile Aggregation

Quantile aggregation with dependence uncertainty has a long history in probability theory with wide applications in finance, risk management, statistics, and operations research. Using a recent resu...

Merging sequential e-values via martingales

We study the problem of merging sequential or independent e-values into one e-value or e-process. We describe a class of e-value merging functions via martingales and show that it dominates all merg...

Confidence and discoveries with e-values

We discuss systematically two versions of confidence regions: those based on p-values and those based on e-values, a recent alternative to p-values. Both versions can be applied to multiple hypothes...

E-values: Calibration, combination, and applications

Multiple testing of a single hypothesis and testing multiple hypotheses are usually done in terms of p-values. In this paper we replace p-values with their natural competitor, e-values, which are cl...

The reference interval in higher-order stochastic dominance

Given two random variables taking values in a bounded interval, we study whether one dominates the other in higher-order stochastic dominance depends on the reference interval in the model setting. We...

Hypothesis testing with e-values

This book is written to offer a humble, but unified, treatment of e-values in hypothesis testing. The book is organized into three parts: Fundamental Concepts, Core Ideas, and Advanced Topics. The fir...

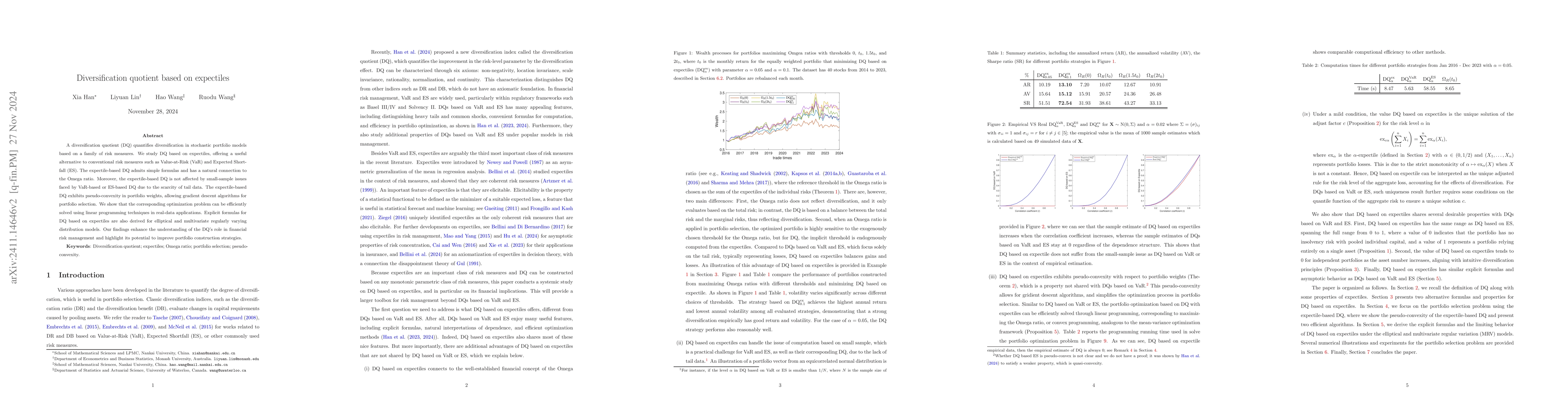

Diversification quotient based on expectiles

A diversification quotient (DQ) quantifies diversification in stochastic portfolio models based on a family of risk measures. We study DQ based on expectiles, offering a useful alternative to conventi...

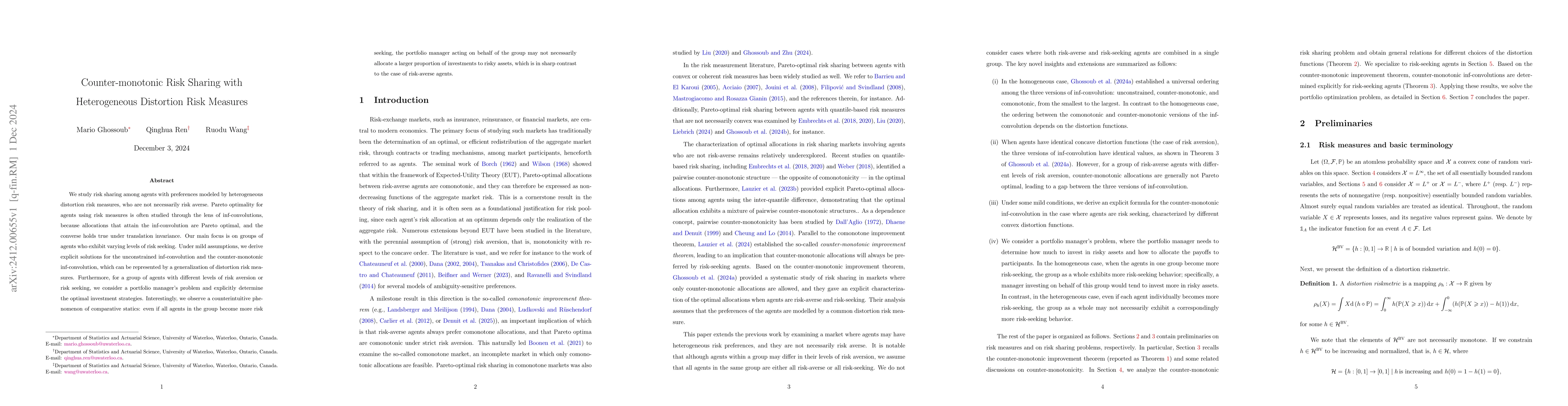

Counter-monotonic Risk Sharing with Heterogeneous Distortion Risk Measures

We study risk sharing among agents with preferences modeled by heterogeneous distortion risk measures, who are not necessarily risk averse. Pareto optimality for agents using risk measures is often st...

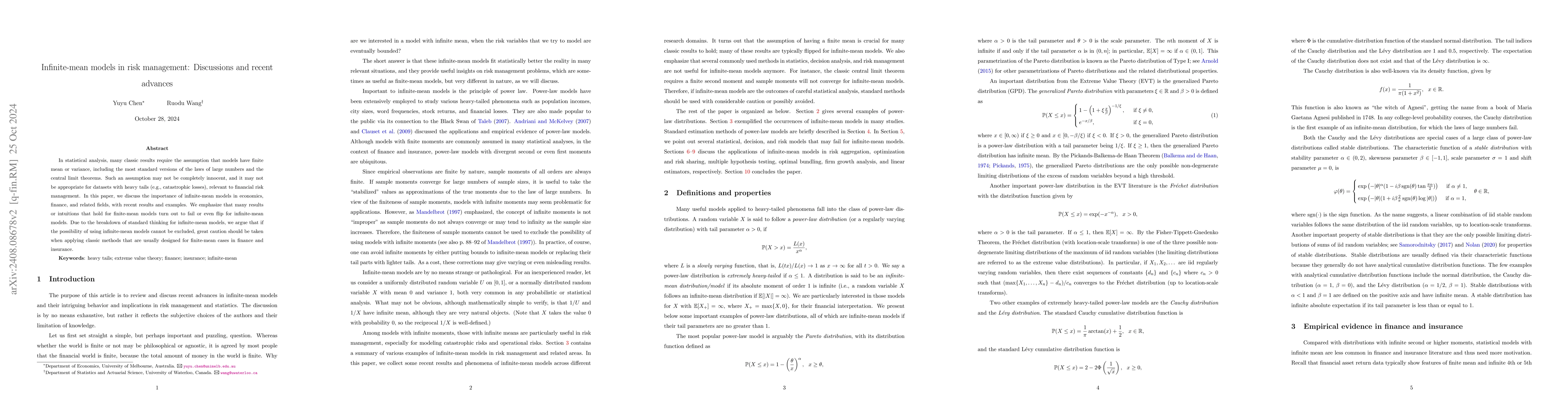

Infinite-mean models in risk management: Discussions and recent advances

In statistical analysis, many classic results require the assumption that models have finite mean or variance, including the most standard versions of the laws of large numbers and the central limit t...

Counter-monotonic risk allocations and distortion risk measures

In risk-sharing markets with aggregate uncertainty, characterizing Pareto-optimal allocations when agents might not be risk averse is a challenging task, and the literature has only provided limited e...

Compound e-values and empirical Bayes

We explicitly define the notion of (exact or approximate) compound e-values which have been implicitly presented and extensively used in the recent multiple testing literature. We show that every FDR ...

The only admissible way of merging e-values

We prove that the only admissible way of merging e-values is to use a weighted arithmetic average. This result completes the picture of merging methods for e-values, and generalizes the result of Vovk...

Improved thresholds for e-values

The rejection threshold used for e-values and e-processes is by default set to $1/\alpha$ for a guaranteed type-I error control at $\alpha$, based on Markov's and Ville's inequalities. This threshold ...

Quantiles under ambiguity and risk sharing

Choquet capacities and integrals are central concepts in decision making under ambiguity or model uncertainty, pioneered by Schmeidler. Motivated by risk optimization problems for quantiles under ambi...

Prudence and higher-order risk attitudes in the rank-dependent utility model

We obtain a full characterization of consistency with respect to higher-order stochastic dominance within the rank-dependent utility model. Different from the results in the literature, we do not assu...

Quadratic-form Optimal Transport

We introduce the framework of quadratic-form optimal transport (QOT), whose transport cost has the form $\iint c\,\mathrm{d}\pi \otimes\mathrm{d}\pi$ for some coupling $\pi$ between two marginals. Int...

On convex order and supermodular order without finite mean

Many results on the convex order in the literature were stated for random variables with finite mean. For instance, a fundamental result in dependence modeling is that the sum of a pair of random rand...

Choquet rating criteria, risk measures, and risk consistency

Credit ratings are widely used by investors as a screening device. We introduce and study several natural notions of risk consistency that promote prudent investment decisions in the framework of Choq...

Eliciting reference measures of law-invariant functionals

Law-invariant functionals are central to risk management and assign identical values to random prospects sharing the same distribution under an atomless reference probability measure. This measure is ...

Disappointment Aversion and Expectiles

This paper recasts Gul (1991)'s theory of disappointment aversion in a Savage framework, with general outcomes, new explicit axioms of disappointment aversion, and novel explicit representations. Thes...

Validity and Power of Heavy-Tailed Combination Tests under Asymptotic Dependence

Heavy-tailed combination tests, such as the Cauchy combination test and harmonic mean p-value method, are widely used for testing global null hypotheses by aggregating dependent p-values. However, the...

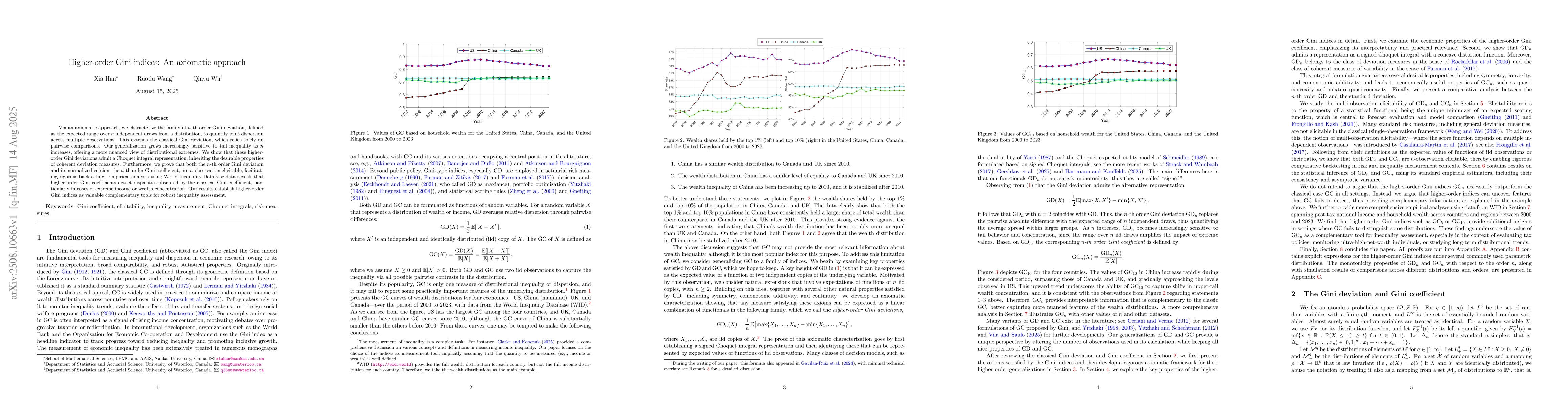

Higher-order Gini indices: An axiomatic approach

Via an axiomatic approach, we characterize the family of n-th order Gini deviation, defined as the expected range over n independent draws from a distribution, to quantify joint dispersion across mult...

Choquet rank-dependent utility

We propose a new decision model under ambiguity, called the Choquet rank-dependent utility model. The model extends the Choquet expected utility model by allowing for the reduction to the rank-depende...

Invariant Modeling for Joint Distributions

A common theme underlying many problems in statistics and economics involves the determination of a systematic method of selecting a joint distribution consistent with a specified list of categorical ...

Optimal allocations with distortion risk measures and mixed risk attitudes

We study Pareto-optimal risk sharing in economies with heterogeneous attitudes toward risk, where agents' preferences are modeled by distortion risk measures. Building on comonotonic and counter-monot...