Summary

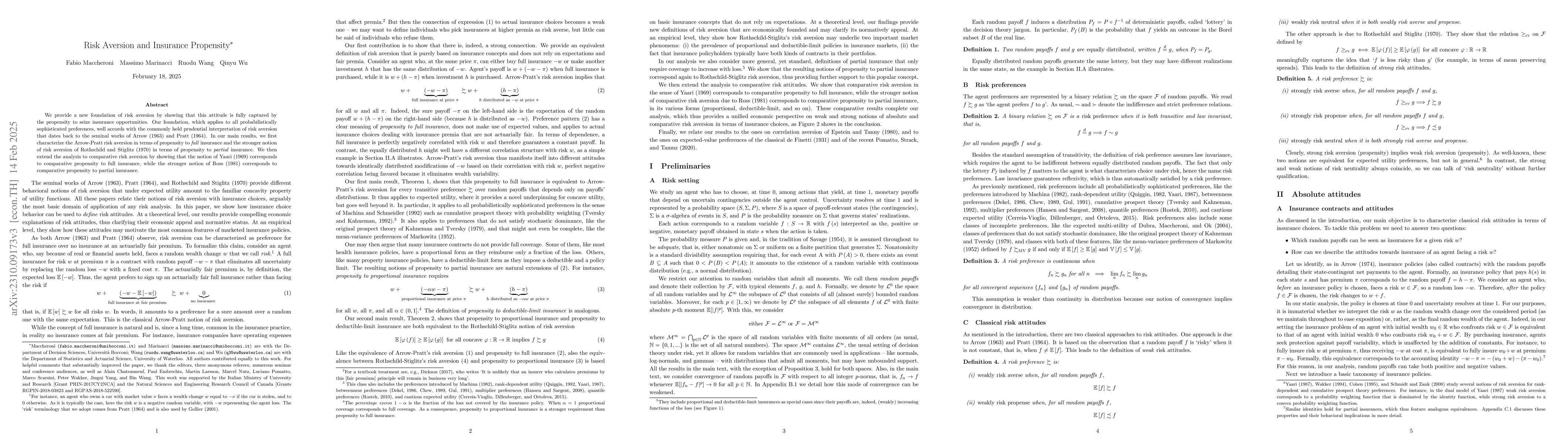

We provide a new foundation of risk aversion by showing that the propension to exploit insurance opportunities fully describes this attitude. Our foundation, which applies to any probabilistically sophisticated preference, well accords with the commonly held prudential interpretation of risk aversion that dates back to the seminal works of Arrow (1963) and Pratt (1964). In our main results, we first characterize the Arrow-Pratt risk aversion in terms of propension to full insurance and the stronger notion of risk aversion of Rothschild and Stiglitz (1970) in terms of propension to partial insurance. We then extend the analysis to comparative risk aversion by showing that the notion of Yaari (1969) corresponds to comparative propension to full insurance, while the stronger notion of Ross (1981) corresponds to comparative propension to partial insurance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)