Authors

Summary

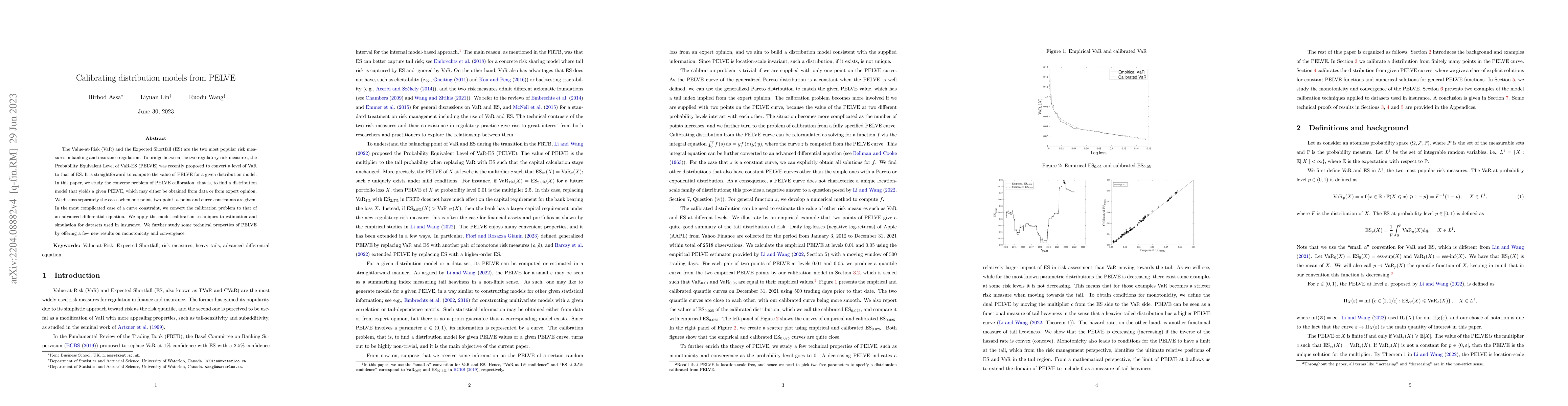

The Value-at-Risk (VaR) and the Expected Shortfall (ES) are the two most popular risk measures in banking and insurance regulation. To bridge between the two regulatory risk measures, the Probability Equivalent Level of VaR-ES (PELVE) was recently proposed to convert a level of VaR to that of ES. It is straightforward to compute the value of PELVE for a given distribution model. In this paper, we study the converse problem of PELVE calibration, that is, to find a distribution model that yields a given PELVE, which may either be obtained from data or from expert opinion. We discuss separately the cases when one-point, two-point, n-point and curve constraints are given. In the most complicated case of a curve constraint, we convert the calibration problem to that of an advanced differential equation. We apply the model calibration techniques to estimation and simulation for datasets used in insurance. We further study some technical properties of PELVE by offering a few new results on monotonicity and convergence.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn Calibrating Diffusion Probabilistic Models

Zhijie Deng, Min Lin, Cheng Lu et al.

Calibrating Likelihoods towards Consistency in Summarization Models

Livio Baldini Soares, Rishabh Joshi, Misha Khalman et al.

Calibrating Verbalized Probabilities for Large Language Models

Cheng Wang, Gyuri Szarvas, Georges Balazs et al.

No citations found for this paper.

Comments (0)