Summary

We present a general framework for a comparative theory of variability measures, with a particular focus on the recently introduced one-parameter families of inter-Expected Shortfall differences and inter-expectile differences, that are explored in detail and compared with the widely known and applied inter-quantile differences. From the mathematical point of view, our main result is a characterization of symmetric and comonotonic variability measures as mixtures of inter-Expected Shortfall differences, under a few additional technical conditions. Further, we study the stochastic orders induced by the pointwise comparison of inter-Expected Shortfall and inter-expectile differences, and discuss their relationship with the dilation order. From the statistical point of view, we establish asymptotic consistency and normality of the natural estimators and provide a rule of the thumb for cross-comparisons. Finally, we study the empirical behaviour of the considered classes of variability measures on the S&P 500 Index under various economic regimes, and explore the comparability of different time series according to the introduced stochastic orders.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

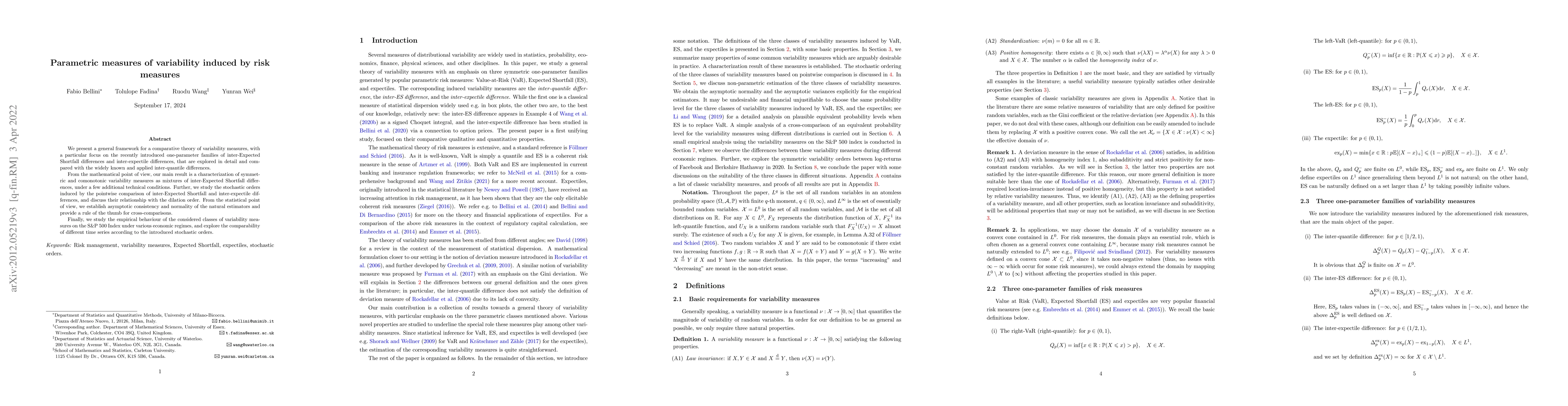

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMeasures of Variability for Risk-averse Policy Gradient

Jiaqi Tan, Pascal Poupart, Yangchen Pan et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)