Summary

The Expected Shortfall (ES) is one of the most important regulatory risk measures in finance, insurance, and statistics, which has recently been characterized via sets of axioms from perspectives of portfolio risk management and statistics. Meanwhile, there is large literature on insurance design with ES as an objective or a constraint. A visible gap is to justify the special role of ES in insurance and actuarial science. To fill this gap, we study characterization of risk measures induced by efficient insurance contracts, i.e., those that are Pareto optimal for the insured and the insurer. One of our major results is that we characterize a mixture of the mean and ES as the risk measure of the insured and the insurer, when contracts with deductibles are efficient. Characterization results of other risk measures, including the mean and distortion risk measures, are also presented by linking them to different sets of contracts.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

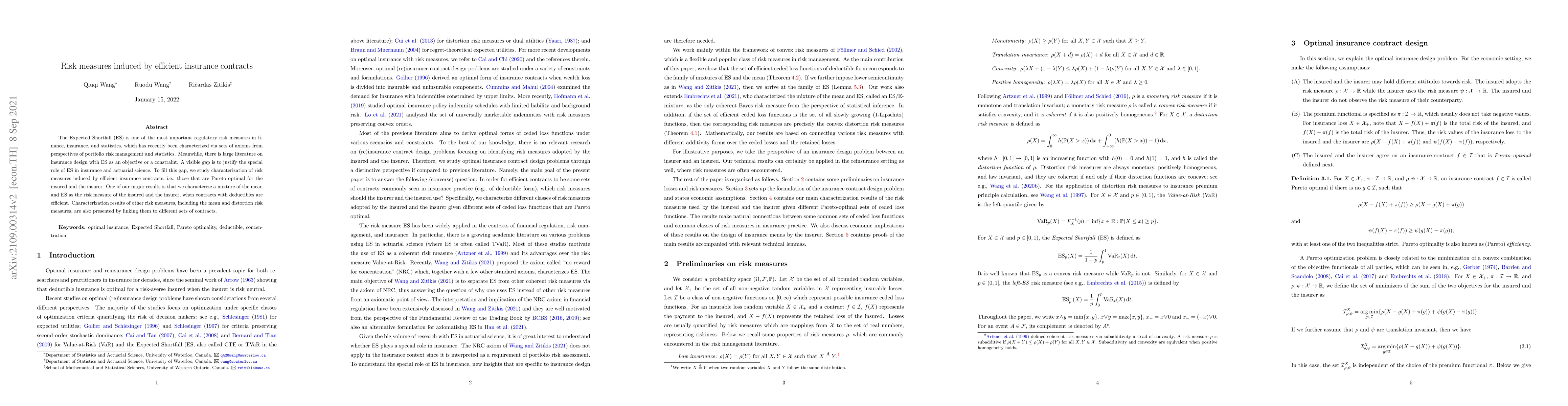

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)