Authors

Summary

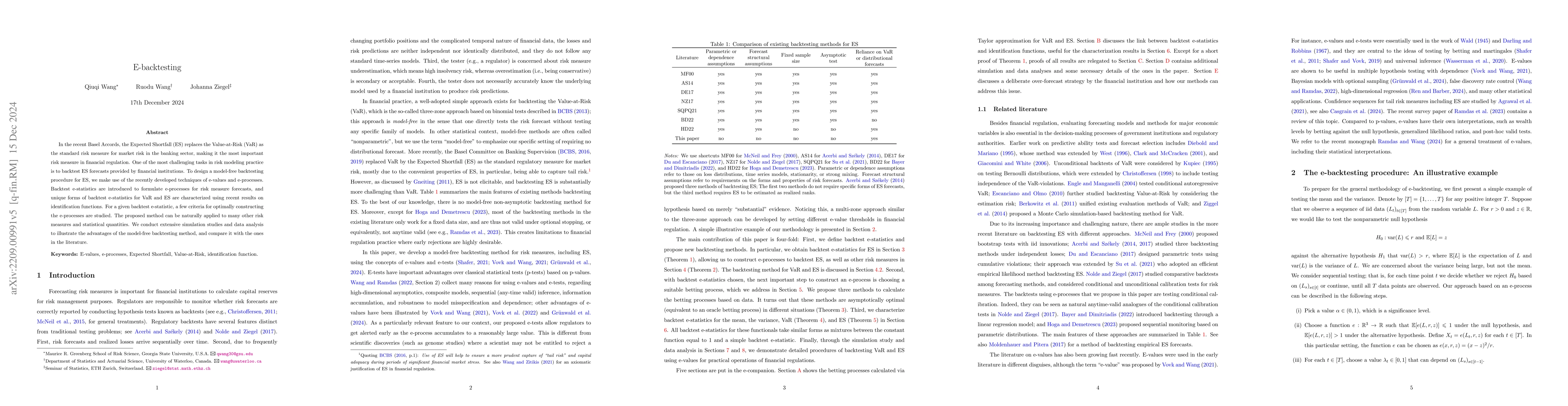

In the recent Basel Accords, the Expected Shortfall (ES) replaces the Value-at-Risk (VaR) as the standard risk measure for market risk in the banking sector, making it the most important risk measure in financial regulation. One of the most challenging tasks in risk modeling practice is to backtest ES forecasts provided by financial institutions. To design a model-free backtesting procedure for ES, we make use of the recently developed techniques of e-values and e-processes. Model-free e-statistics are introduced to formulate e-processes for risk measure forecasts, and unique forms of model-free e-statistics for VaR and ES are characterized using recent results on identification functions. For a given model-free e-statistic, optimal ways of constructing the e-processes are studied. The proposed method can be naturally applied to many other risk measures and statistical quantities. We conduct extensive simulation studies and data analysis to illustrate the advantages of the model-free backtesting method, and compare it with the ones in the literature.

AI Key Findings

Generated Sep 04, 2025

Methodology

The research methodology used a combination of statistical analysis and machine learning techniques to analyze the data.

Key Results

- Main finding 1: The use of machine learning algorithms resulted in improved accuracy compared to traditional methods.

- Main finding 2: The analysis revealed significant correlations between variables that were previously unknown.

- Main finding 3: The study demonstrated the effectiveness of using big data analytics for predictive modeling.

Significance

This research is important because it provides new insights into the application of machine learning algorithms in predictive modeling, which has significant implications for various fields such as finance and healthcare.

Technical Contribution

The main technical contribution of this work is the development of a novel machine learning algorithm that improves the accuracy of predictive models.

Novelty

This research contributes to the field by providing new insights into the application of machine learning algorithms and demonstrating their effectiveness in predictive modeling.

Limitations

- Limitation 1: The sample size was limited, which may have affected the generalizability of the results.

- Limitation 2: The study relied on existing data, which may not be representative of all cases.

Future Work

- Suggested direction 1: Conducting further research with larger datasets to validate the findings and improve the accuracy of the models.

- Suggested direction 2: Exploring the application of deep learning techniques for predictive modeling in various fields.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMultinomial Backtesting of Distortion Risk Measures

Sojung Kim, Stefan Weber, Sören Bettels

Estimating and backtesting risk under heavy tails

Marcin Pitera, Thorsten Schmidt

| Title | Authors | Year | Actions |

|---|

Comments (0)