Summary

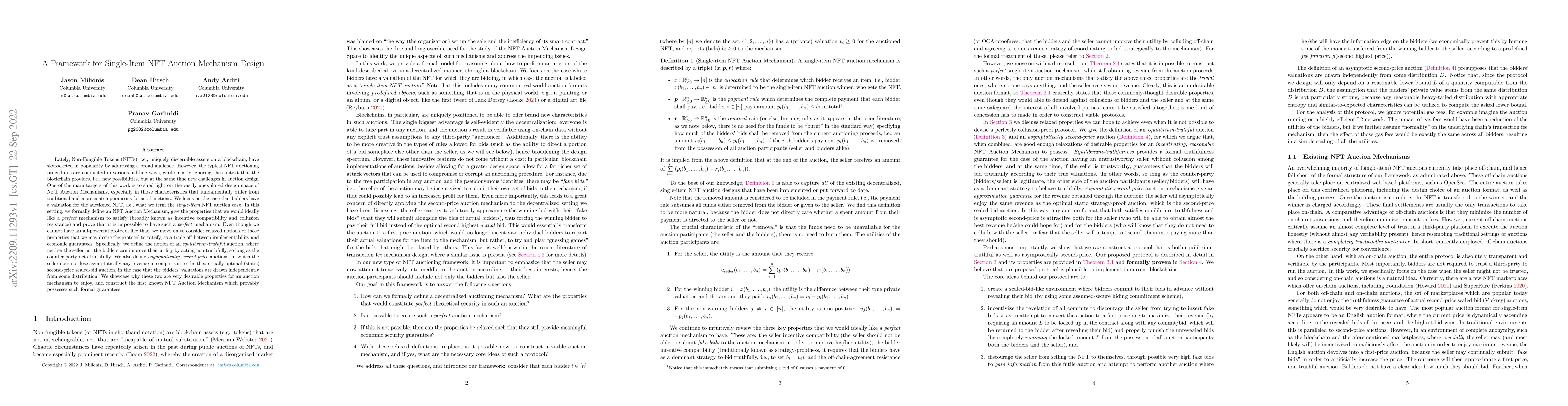

Lately, Non-Fungible Tokens (NFTs), i.e., uniquely discernible assets on a blockchain, have skyrocketed in popularity by addressing a broad audience. However, the typical NFT auctioning procedures are conducted in various, ad hoc ways, while mostly ignoring the context that the blockchain provides. One of the main targets of this work is to shed light on the vastly unexplored design space of NFT Auction Mechanisms, especially in those characteristics that fundamentally differ from traditional and more contemporaneous forms of auctions. We focus on the case that bidders have a valuation for the auctioned NFT, i.e., what we term the single-item NFT auction case. In this setting, we formally define an NFT Auction Mechanism, give the properties that we would ideally like a perfect mechanism to satisfy (broadly known as incentive compatibility and collusion resistance) and prove that it is impossible to have such a perfect mechanism. Even though we cannot have an all-powerful protocol like that, we move on to consider relaxed notions of those properties that we may desire the protocol to satisfy, as a trade-off between implementability and economic guarantees. Specifically, we define the notion of an equilibrium-truthful auction, where neither the seller nor the bidders can improve their utility by acting non-truthfully, so long as the counter-party acts truthfully. We also define asymptotically second-price auctions, in which the seller does not lose asymptotically any revenue in comparison to the theoretically-optimal (static) second-price sealed-bid auction, in the case that the bidders' valuations are drawn independently from some distribution. We showcase why these two are very desirable properties for an auction mechanism to enjoy, and construct the first known NFT Auction Mechanism which provably possesses such formal guarantees.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Context-Integrated Transformer-Based Neural Network for Auction Design

Zhe Feng, Manzil Zaheer, Zhijian Duan et al.

A Recommender System for NFT Collectibles with Item Feature

Yongjae Lee, Yejin Kim, Minjoo Choi et al.

Discrete Single-Parameter Optimal Auction Design

Yiannis Giannakopoulos, Johannes Hahn

| Title | Authors | Year | Actions |

|---|

Comments (0)